10 Types of Loan Management Software (and Which One You Actually Need)

Running a lending business today isn’t about finding borrowers – it’s about managing complexity.

Spreadsheets, legacy CRMs, and one-off tools can get you started, but they don’t scale.

At some point, the cracks start to show: payments delayed, compliance reports missed, borrowers frustrated, and teams working nights just to keep the book balanced.

That’s when most CEOs realize they don’t just need a system — they need the right one.

The challenge? Loan management software (LMS) isn’t one-size-fits-all.

Auto finance isn’t the same as bridge lending. Consumer loans look very different from commercial portfolios. And yet most vendors sound the same.

In this guide, we’ll break down the 10 major types of LMS – what they do, who they’re built for, and how to know which fits your lending model.

Whether you’re scaling a specialist loan book or running diversified portfolios, this is your roadmap out of Excel and into modern, automated operations.

📘 Free Workbook: Loan Management Software Comparison Workbook

A practical workbook to help you compare, assess and plan next steps with selecting an alternative for spreadsheets. Define features which matter most to your business, compare, analyse and ask the right questions.

Moving Beyond Excel: Why Spreadsheets Stop Scaling

Every lender starts with Excel. It’s fast, familiar, and free. But once your loan book grows past a handful of deals, the cracks appear.

Our latest survey of 300 lending CEOs found that 1 in 3 still manage their portfolios in spreadsheets – and most admit it’s their biggest operational bottleneck.

Why do they stick with it? Because Excel feels simple. No training, no onboarding, just cells and formulas. But simplicity comes at a cost:

- Errors multiply. One wrong formula or misplaced row can ripple across repayments and investor reporting.

- No audit trail. Regulators demand transparency. Excel doesn’t provide it.

- Manual drag. Updating balances, chasing repayments, and reconciling reports eats hours every week.

- Security risks. Sensitive borrower data in unsecured files is a compliance nightmare.

That’s where loan management software (LMS) is so powerful.

Instead of patching holes with workarounds, LMS platforms automate the critical workflows Excel can’t handle:

- Origination decisions run on consistent rules.

- Servicing tasks like payment reminders and reconciliations happen automatically.

- Compliance reports generate in real time.

The result? Teams reclaim time, borrowers get smoother experiences, and lenders unlock the ability to scale without hiring armies of ops staff.

The Diversity of Loan Management Software

Not all lenders face the same challenges. A microfinance institution serving thousands of small borrowers in emerging markets doesn’t need the same toolkit as a property lender managing a dozen seven-figure bridge loans.

That’s why the loan management software market has splintered into specialized platforms built for different lending models.

In our latest survey of 300 lending CEOs, more than 40% said short-term lending was their primary product, followed closely by personal loans and business finance. That mix of needs is exactly why there isn’t a one-size-fits-all solution.

Some systems focus on origination and onboarding speed. Others are designed for servicing at scale. And a few aim to be end-to-end — handling everything from underwriting to collections.

The upside? Whatever your loan book looks like — auto, consumer, business, mortgage, or even cross-border — there’s now a purpose-built LMS designed to reduce risk, improve compliance, and help you scale.

Here’s a breakdown of the 10 most common types of loan management software — what they do best, who they’re built for, and the risks they solve.

10 Types of LMS

1. Loan Origination Software

Loan Origination Software (LOS) automates and streamlines the loan application and approval process, enhancing efficiency for lenders and borrowers.

Key features include:

- Automated application management to reduce errors and simplify documentation.

- Credit decisioning tools powered by data analytics for faster, accurate underwriting.

- Real-time communication to keep borrowers and teams informed.

- Compliance tracking with audit trails to ensure regulatory adherence.

The main advantage of LOS is its ability to reduce time-to-decision. By automating repetitive tasks like data entry and risk assessment, lenders can significantly cut approval times while improving borrower satisfaction.

Key benefits:

- Scalable and configurable workflows for diverse lending needs.

- Cloud-based architecture for flexibility and growth.

- Secure integrations with CRMs and payment systems.

Loan Origination Software empowers lenders to process more applications efficiently, scale operations, and deliver exceptional borrower experiences, all while ensuring compliance in a competitive lending environment.

2. Loan Servicing Software

Loan Servicing Software (LSS) streamlines the management of active loans, from payment collection to portfolio monitoring, ensuring efficiency and borrower satisfaction.

Key features include:

- Automated payment processing to reduce manual work and errors.

- Delinquency management with automated reminders and escalation workflows.

- Real-time reporting for loan performance tracking and insights.

- Compliance tools to ensure adherence to regulatory requirements.

Put simply:

LSS simplifies loan administration. By automating tasks like repayment tracking and account updates, lenders can manage larger portfolios without increasing overhead.

Key benefits:

- Seamless borrower communication via multi-channel notifications.

- Cloud-based scalability for growing operations.

- Integration capabilities with accounting and CRM systems.

Loan Servicing Software empowers lenders to maintain operational efficiency, reduce delinquency rates, and provide borrowers with a seamless experience – all while ensuring financial compliance and operational transparency.

3. Auto Loan Management Software

Auto Loan Management Software, a specialized loan management system, offers the following features with the integration of a loan management system software:

- Automates payment processing

- Simplifies payment for borrowers

- Tracks loan performance for lenders

- Offers compliance and efficiency automations

- Collateral tracking

- Capability to expand lending products for customers

The notable advantage of Auto Loan Management Software is its loan performance monitoring capability. By offering data analytics capabilities, it enables real-time monitoring of loan portfolios and early detection of potential risks.

This provides lenders with valuable insights into their auto loan operations and helps them make informed decisions.

Key characteristics of Auto Loan Management Software include:

- Cloud-based capabilities

- Configurable software for scalability and flexibility

- Security features

- Automation of loan processes

- Loan origination and servicing

- Customer account administration

These features make it an ideal solution for lenders dealing with auto loans.

4. Consumer Lending Software

Another specialized LMS, Consumer Lending Software, helps financial institutions manage and automate individual consumer lending processes efficiently.

Its key components often encompass a loan origination system, which includes:

- Loan origination

- Credit decisioning

- Documentation management

- Self-service channels

This software facilitates lenders, including credit unions, in meeting consumer expectations and optimizing the borrowing process. It simplifies the disbursement of personal loans, credit cards, and other consumer credit products, providing a streamlined and efficient system for managing consumer loans.

Regulatory compliance capabilities stand out as a critical feature of Consumer Lending Software and typically include:

- Fair lending software for staying ahead of compliance regulations

- Capabilities for ensuring adherence to local and international regulations

This ensures that lenders stay compliant while providing an efficient service to their customers.

5. Commercial Lending Software

Commercial Lending Software is tailored to enhance the management of business loans, credit lines, and other commercial financing products. It provides numerous advantages to lenders, including:

- Optimization of profitability

- Reduction of human errors

- Time and cost savings

- Facilitation of quick evaluation of loan applications

- Identification of potential risks

- Efficient tracking of loan performance

- Automation of various loan management processes

Commercial Lending Software enhances the lending process with its proficient risk assessment capabilities. It offers the following benefits:

- Provides automated credit evaluations that offer a thorough insight into a borrower’s financial history

- Assists lenders in making well-informed decisions on credit risk

- Streamlines the lending process

- Enhances the overall customer experience.

An additional benefit of Commercial Lending Software is its capacity to bolster effective portfolio management.

By providing lenders with a comprehensive solution for managing the entire end to end process of commercial loans, it enables more informed decision-making and effective management of large loan portfolios.

6. Microfinance Software

Microfinance Software is tailored to meet the specific requirements of microfinance institutions.

It offers tools for loan origination, portfolio management, and impact measurement, providing a comprehensive solution for these organizations.

This software offers numerous advantages over traditional lending systems, including:

- Easier qualification for loans

- Shorter loan maturities

- Enhanced access to financial services

- Seamless integration with other systems used within microfinance institutions

It also incorporates features specifically crafted for microfinance management, encompassing customer relationship management, loan origination, loan portfolio management, and accounting.

Furthermore, it offers utilities such as AI-accelerated credit scoring, real-time loan portfolio performance insights, and streamlined analysis of loan performance data.

7. Bridge Loan Software

Bridge Loan Software aids lenders in overseeing short-term, high-interest loans, typically used to bridge financing gaps. It encompasses the following functionalities:

- Digital signature

- Loan origination

- API integration

- Accounting

- Activity dashboard

- Activity tracking

- Alerts/notifications

All of these functionalities are designed to optimize and streamline the lending process.

Bridge Loan Software improves the lending process with its collateral tracking capabilities and loan origination software features.

It offers a streamlined method for handling the loan process, from application intake to document management and processing client information, including details about the collateral.

Another benefit of loan management software:

It calculates the loan-to-value (LTV) ratio by dividing the amount of the loan by the appraised value of the collateral property. This provides lenders with a key metric for evaluating the risk associated with a loan.

8. Mortgage Loan Management Software

Mortgage Loan Management Software supports lenders in managing complex, long-term mortgage loans. It’s tailored to handle high-value home loans, offering robust automation, compliance, and document handling capabilities.

This software ensures smooth handling of mortgages with built-in tools for everything from origination to customer account management.

- Automates underwriting and credit evaluations

- Tracks escrow, payments, and amortization schedules

- Manages compliance with local mortgage regulations

- Stores and organizes loan documents securely

This software simplifies mortgage portfolio management, providing mortgage lenders with a reliable system for regulatory compliance and efficient servicing.

9. Peer-to-Peer (P2P) Lending Software

Peer-to-Peer Lending Software is designed for platforms that directly connect borrowers with individual investors, enabling seamless transactions and compliance in a rapidly growing market.

It automates complex matching and risk evaluation processes, ensuring that P2P lenders maintain secure and efficient operations.

- Matches borrowers and investors based on risk profiles

- Automates credit scoring and risk assessments

- Distributes payments across multiple investors

- Monitors compliance with P2P lending regulations

For P2P platforms, this software is essential in creating a compliant, user-friendly, and efficient marketplace that builds trust and transparency for investors and borrowers alike.

10. International Loan Management Software

Built for lenders managing cross-border portfolios – like Gaia – International Loan Management Software streamlines multi-country lending with tools for currency management, compliance, and international payments.

It provides an integrated approach to lending across diverse regulatory and economic landscapes.

- Supports multi-currency loan origination and repayments

- Ensures compliance with global regulations

- Processes secure cross-border payments

- Localizes for language and cultural requirements

This software allows international lenders to operate smoothly across borders, enhancing their capacity to meet local requirements and scale effectively in global markets.

Nader AlSalim

“LendFusion made the transition effortless and gave us the scalability and automation we needed to grow without increasing our team size.

Not only have they helped us streamline loan tracking and payments, but their support has been integral in allowing us to expand across multiple markets without any operational disruption.

We can now focus on the bigger picture – helping more families achieve their dream of starting a family through IV”

3 Ways Modern Software Enhances Lending Efficiency

Modern loan management software features boost efficiency for lenders through cloud-based platforms, integrated analytics, and loan processing automation.

These advancements in technology have revolutionized the lending industry, offering lenders an efficient and effective way to manage their loan portfolios.

1. Cloud-Based Loan Management Platforms

With Cloud-Based Loan Management Platforms, lenders can access their loan portfolios from anywhere at any time, provided they have an internet connection.

This level of accessibility is a significant upgrade from traditional on-premise systems, which require lenders to be physically present at their office to access their systems.

2. Integrated Analytics for Informed Decision-Making

Integrated Analytics delivers valuable insights into loan performance for lenders.

These insights help lenders to better understand their borrowers and make informed lending decisions, which leads to more precise risk modeling and decreased loss rates – making integrated analytics an invaluable tool for lenders.

3. Automation in Loan Processing

Automation in Loan Processing effectively reduces errors and enhances efficiency, especially in areas such as underwriting, loan servicing, and collections.

These tasks, which would be significantly more time-consuming if performed manually, can be automated with LMS, resulting in a more streamlined and efficient loan management process.

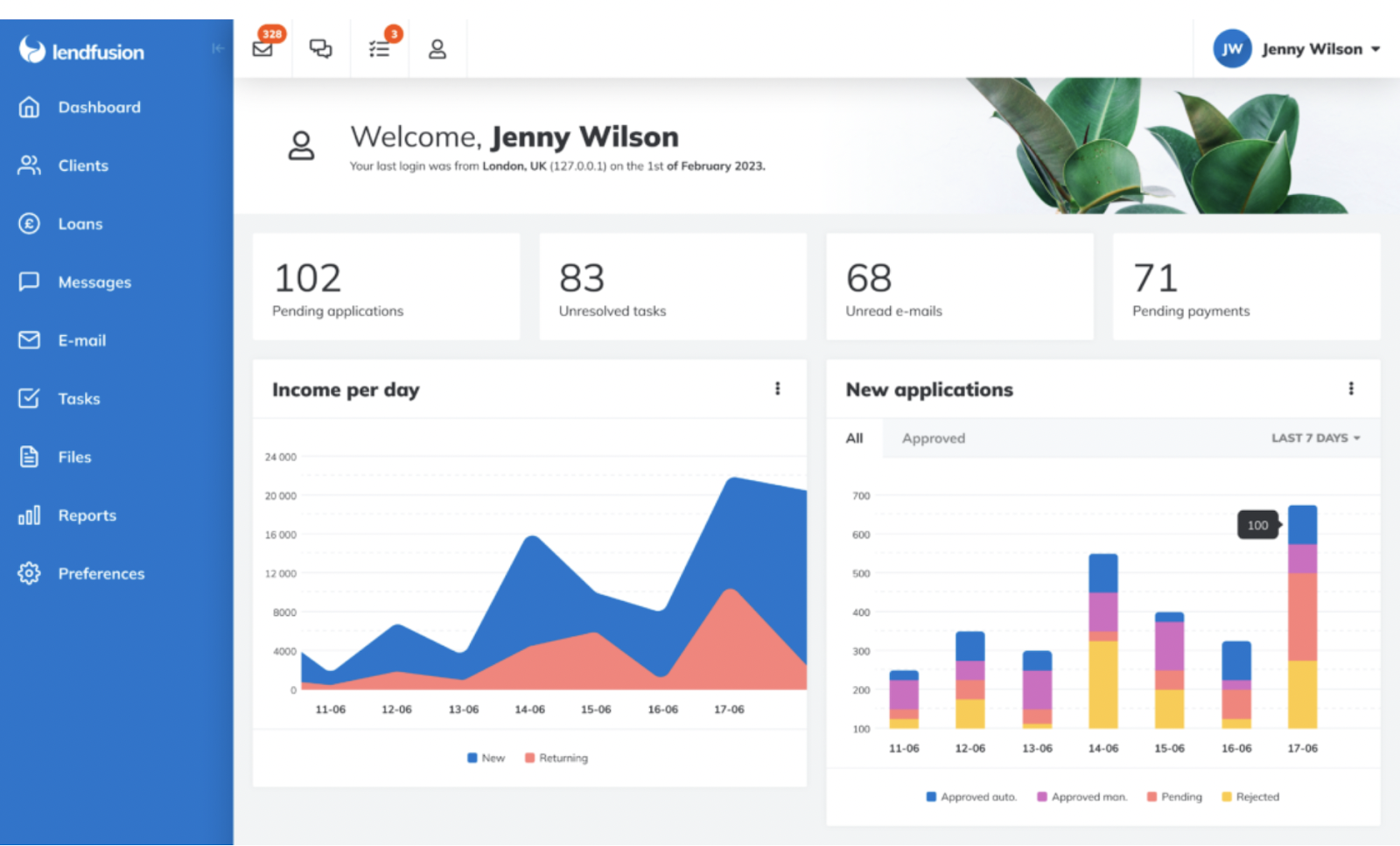

What type of LMS is LendFusion?

LendFusion is a comprehensive solution for lenders that addresses the needs and complexities across different loan types, from auto loans and consumer lending to commercial lending and more.

This versatility ensures that whether a lender specializes in a single loan type or offers a range of lending services, LendFusion can provide an integrated, efficient platform that simplifies operations, enhances borrower experience, and reduces errors through automation and advanced data analytics.

By offering a cloud-based, configurable, and secure environment, LendFusion empowers lenders to expand their product offerings, optimize profitability, and make informed decisions through comprehensive analytics – all while ensuring a seamless and compliant borrower experience across the board.

See how the different types of LMS compare in the table below:

| LMS Type | Description | Best For | Suggested Platforms |

|---|---|---|---|

| Loan Origination Software | Automates loan applications, credit checks, and approval process. | Banks, digital lenders, credit unions | LendFusion, Finastra, HES FinTech |

| Loan Servicing Software | Manages payments, collections, and loan tracking. | Loan servicing teams and operations | LendFusion, LoanPro, TurnKey Lender |

| Auto Loan Management Software | Tailored for auto loans: payment tracking, compliance, and collateral. | Auto finance providers | LendFusion, Appello, HES FinTech |

| Consumer Lending Software | Handles consumer loans: credit checks, docs, self-service, compliance. | Credit unions, personal lenders | LendFusion, BrightOffice, Finastra |

| Commercial Lending Software | Supports business loans: credit lines, portfolio tracking, automation. | Commercial lenders and B2B finance | LendFusion, LoanPro, Finastra |

| Microfinance Software | Built for microloans: portfolio mgmt, AI scoring, impact tracking. | Microfinance institutions | LendFusion, Mifos, Musoni |

| Bridge Loan Software | Designed for short-term loans: origination, LTV calc, collateral mgmt. | Real estate lenders, short-term finance firms | LendFusion, The Mortgage Office |

| Mortgage Loan Software | Manages mortgage loans: underwriting, escrow, compliance, docs. | Mortgage lenders, housing banks | LendFusion, Finastra, Mortgage Automator |

| P2P Lending Software | Connects borrowers to investors: match, score, monitor compliance. | P2P platforms, fintech startups | LendFusion, Crowdsoft, Madiston |

| International Loan Software | Handles cross-border lending: currency, localization, global rules. | Global lenders and institutions | LendFusion, Mambu, Finastra |

Conclusion

The journey from Excel to specialized loan management solutions for various loan types, including auto loans, consumer lending, and commercial lending, has revolutionized the lending industry.

Modern features like cloud-based platforms, integrated analytics, and automation in loan processing provide lenders with an efficient and effective way to manage their loan portfolios.

Ready to scale your lending operations? Experience first-hand how LendFusion’s modern loan management solution can help you grow your lending business. Book personalized demo

Lenders Also Ask

How do the specific features of microfinance software contribute to its effectiveness in managing microloans?

The effectiveness of microfinance software in managing microloans is enhanced by its specific features like AI-accelerated credit scoring, real-time loan portfolio performance insights, and streamlined analysis of loan performance data.

These tools aid in efficient loan origination, portfolio management, and impact measurement, catering to the unique needs of microfinance institutions.

In what ways does bridge loan software streamline the management of short-term loans compared to traditional methods?

Bridge loan software streamlines the management of short-term loans by offering features such as digital signature capabilities, API integration for seamless system connections, and efficient loan origination processes.

It also includes tools for activity tracking and alerts, improving the oversight and management of these high-interest, short-term loans.

Can commercial lending software integrate with other business systems to provide a comprehensive view of a commercial borrower’s profile?

Yes, commercial lending software typically offers integration capabilities with other business systems, which allows for a more comprehensive view of a commercial borrower’s profile by consolidating various data points and facilitating better risk assessment and decision-making.

🚀 Ready to Take Your Lending Business to the Next Level?

Download our Loan Management Software Comparison Workbook and have access to the best available LMS comparison workbook. Have the knowledge to make the best possible call and keep your business moving forward!

No fluff — just practical examples, templates, and expert tips.

No sign-up required. Just download and start improving your lending business today.

Andres Valdmann, CEO

Andres is the Chief Executive Officer at LendFusion. Andres has 15 years of experience in fintech and loan management software and has a proven track record in helping companies hit their growth goals.

Connect with Andres on LinkedIn.