5 Benefits of Using Loan Management Software

Loan management software streamlines financial operations, enhances data security, and improves customer relations. The biggest benefits include automating loan origination, managing loan portfolios, providing real-time updates, and leveraging analytics for efficient loan processing and risk management.

Are you searching for a solution to transform your lending operations, simplify risk management, and improve your customer relations?

We’re here to help you.

Welcome to the world of loan management software (LMS).

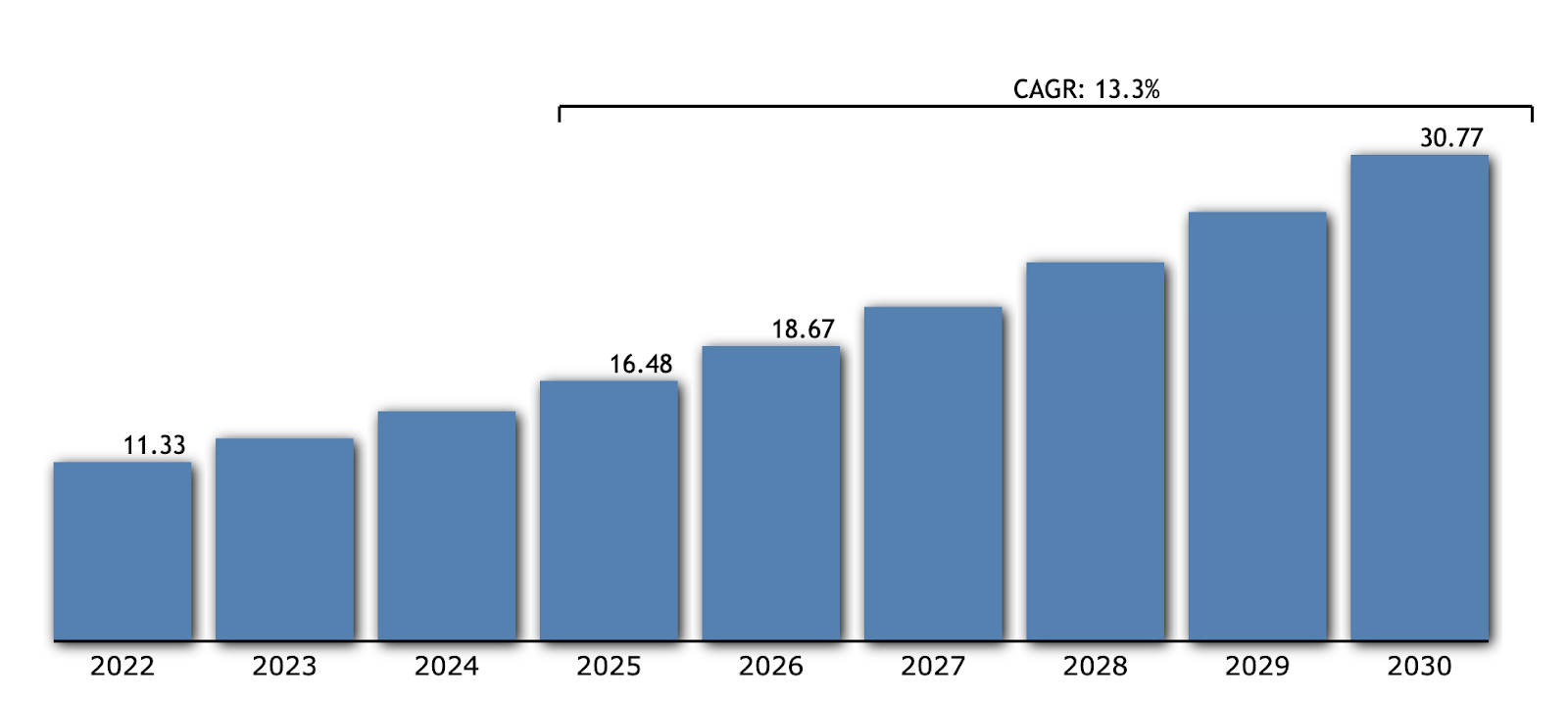

The digital lending industry is growing at a rapid rate:

Forecasts predict that the global digital lending platform market will grow to $30 billion by 2030, showing a CAGR of 13% from 2025 to 2030.

This growth is fueled by the need for efficient loan processing, robust customer data security, and advanced analytics.

In this article, we look at the benefits of loan management software and share how this technology can help you grow your lending business.

Let’s get started.

1. Streamlining Loan Processes

With automation at its core, loan management software expedites the modern loan management system through origination, servicing, and integration, enhancing efficiency and reducing turnaround times.

A key benefit is the centralization of loan data, eliminating the need for physical files and the risk of calculation errors, which simplifies the record management process.

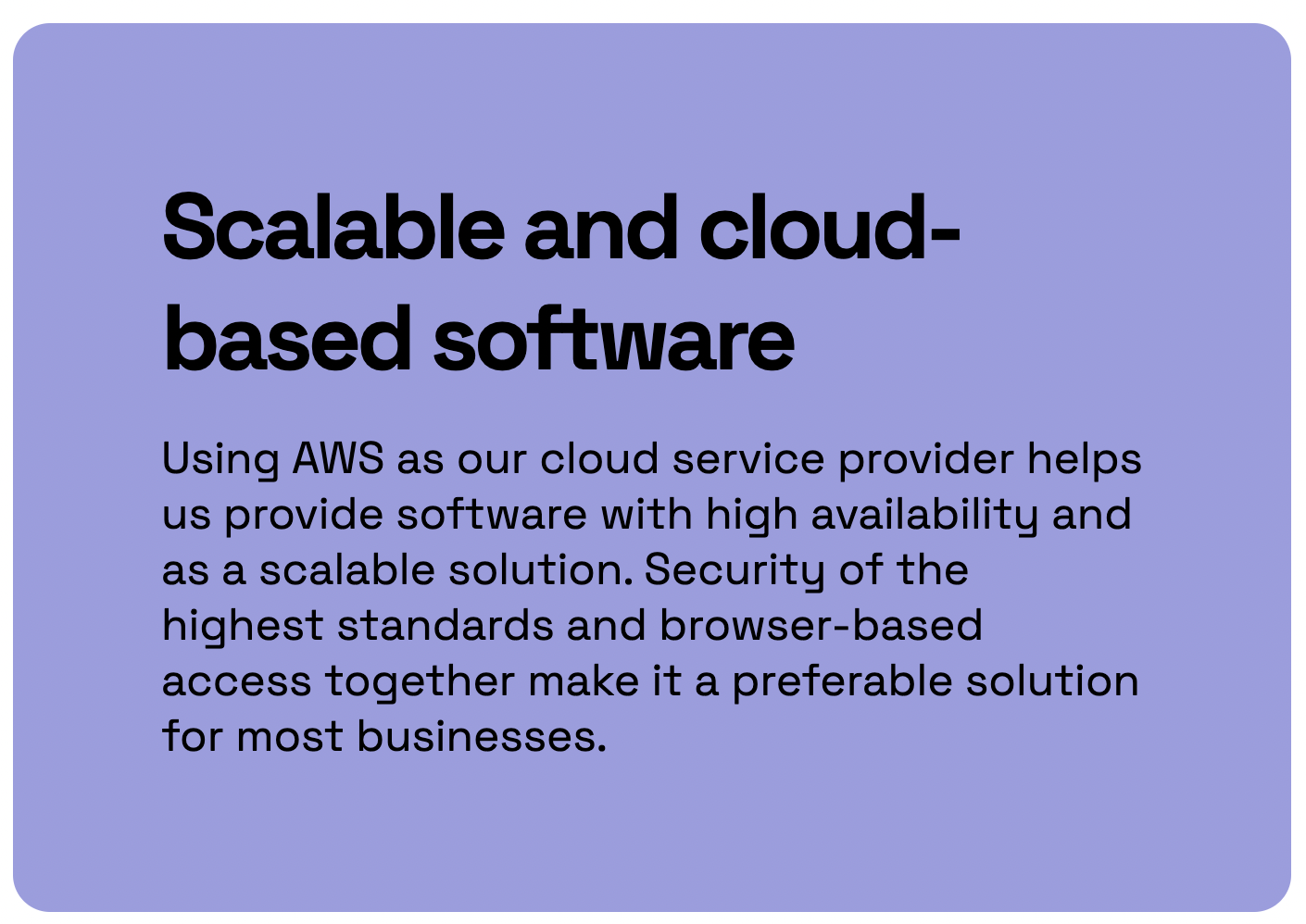

Cloud-based loan servicing software has been pivotal in enhancing the efficiency, security, and convenience of the lending process for both lenders and borrowers.

Key benefits of using cloud-based loan servicing software include:

- Enhanced efficiency in managing loan portfolios

- Improved security and data protection

- Increased accessibility and convenience for borrowers

- Cost-effective pricing model

Faster Loan Origination

One of the biggest benefits of implementing a loan management system is the expedited loan origination process.

By automating time-consuming and manual tasks, the system expedites the application and decision-making phases, such as:

- data interpretation

- ratio analysis

- forecasting models

- loan approvals

- internal paperwork reduction

- document validation

This contemporary approach to loan origination removes the bottlenecks associated with traditional methods and paves the way for a smoother, more efficient lending process.

Efficient Loan Servicing

A successful lending business relies heavily on efficient loan servicing.

By automating tasks such as:

- tracking loan performance

- Invoicing and reporting

- maintaining financial documents

- creating taxation reports

…loan management software streamlines the loan servicing process, providing significant benefits to all parties involved in loan management solutions.

Cloud-based loan management systems further enhance efficiency by mitigating the risk of human error. Their benefits include:

- Automated workflows that guarantee the efficient progression of loan applications through the entire loan process

- Elimination of manual bottlenecks, saving time and ensuring the accuracy of data

- Reduction of the risk of errors that could adversely impact the lending business

Seamless Integration

Another vital feature of modern loan management software is seamless integration.

These platforms can integrate with existing software, enabling a more efficient and tailored lending experience, meeting the unique requirements of both lenders and borrowers.

Through third-party integrations, lenders can swiftly and efficiently authenticate borrower information by utilizing third-party services for credit score checks, income verification, and property valuations.

Thus, integration capabilities play a crucial role in streamlining the lending process and boosting the efficiency of loan management software.

For example, LendFusion integrates with payment solutions, open banking, communication and credit scoring platforms.

2. Enhancing Data Security and Compliance

Data security and compliance is critical.

Loan management software provides a comprehensive solution to these challenges by improving data security by:

- Converting traditional document handling into a secure digital format

- Minimizing exposure to data security risks

- Safeguarding sensitive client information from data theft.

Plus, loan management software offers the following benefits:

- Reduces risks such as lost, copied, or improperly disposed of documents

- Prevents identity theft and financial fraud

- Mitigates the chances of a public relations nightmare and litigation expenses, which are common risks associated with paper documents

- Implements digital security measures to ensure regulatory compliance

It’s hard to imagine doing all of this without a loan management platform.

Secure Document Management

Another important component of loan management software is secure document management. This includes:

- Converting documents into a secure digital format

- Implementing robust security measures to lower the risk of data breaches

- Safeguarding the confidentiality of sensitive information.

These systems prioritize the improvement project of the document management system by:

- Digitizing paperwork

- Storing documents in a secure cloud-based system

- Implementing security measures to safeguard loan documents from unauthorized access or loss

Secure document management not only enhances data security but also ensures efficient and accurate data management critical information together.

3. Improving Customer Experience

Loan management software greatly enhances the customer experience by simplifying the loan application process and providing real-time updates.

Borrowers can conveniently request loans online and receive quicker credit decisions.

Adding to this:

Personalized communication channels serve to enhance transparency and establish trust through customized interactions and information delivery to borrowers.

These channels play a crucial role in minimizing wait times and alleviating borrower concerns, thereby keeping customers well-informed and involved in their loan application journey.

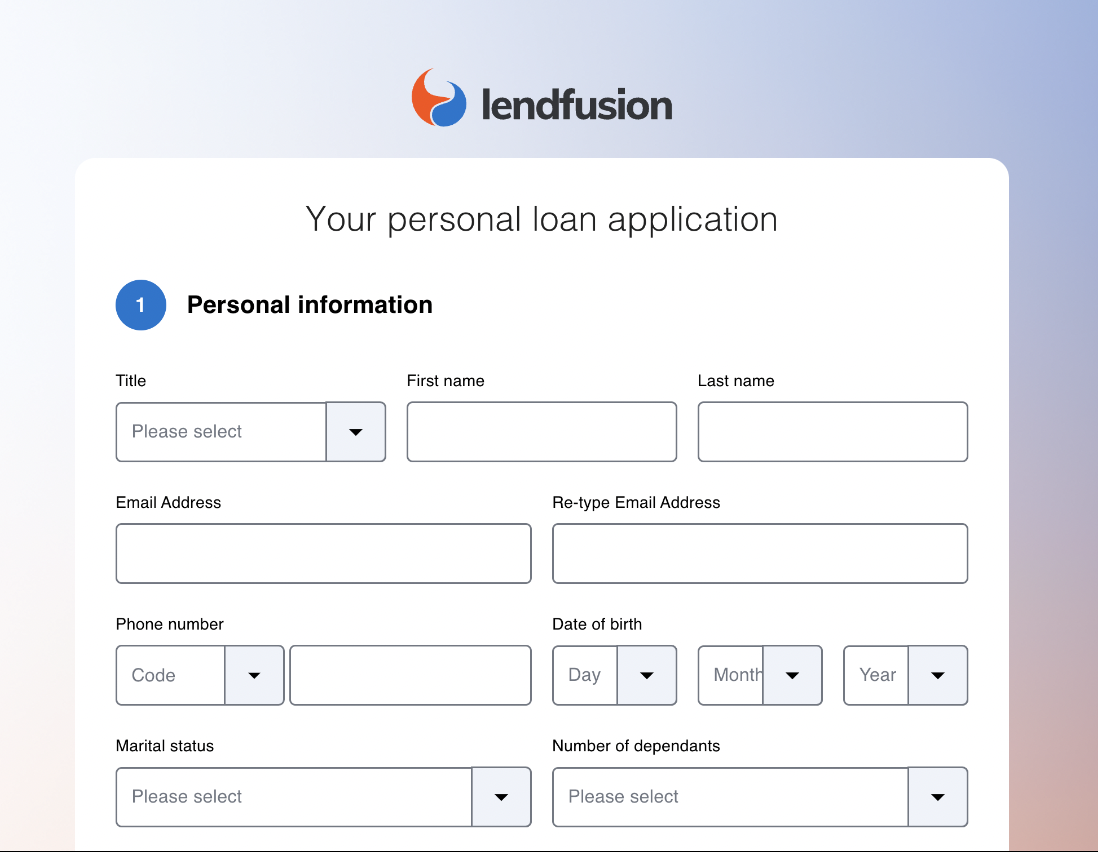

Digital Loan Applications

The lending sector is riding the wave of the digital transformation, as online loan applications become increasingly popular. These platforms simplify the application process, enabling borrowers to submit their documents online and receive quicker decisions.

This not only speeds up the process but also significantly improves the customer experience

This approach to loan applications eliminates the necessity for in-person visits to branches, leading to cost savings and significantly improved customer satisfaction.

Digital loan applications not only make the lending process more efficient but also ensure a positive customer experience.

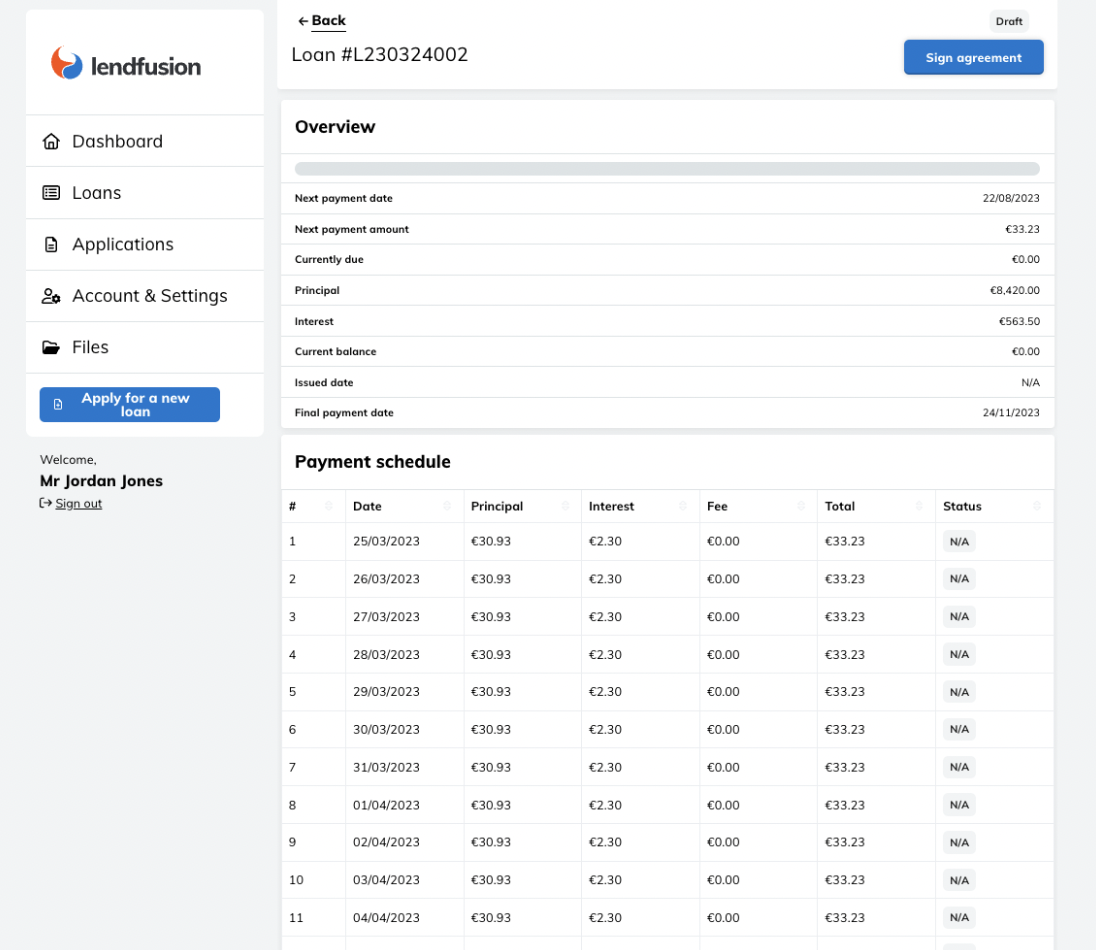

Real-time Updates and Communication

Just like any business, communication plays a key role in the lending industry.

Loan management software enhances the customer experience by providing real-time updates on loan status. This enables borrowers to conveniently monitor their progress at any time, thereby improving transparency in the loan process.

Real-time communication channels offer the following benefits to borrowers:

- Keeping borrowers informed throughout the lending process

- Contributing to higher customer satisfaction and retention

- Fostering trust

- Keeping borrowers well-informed throughout their lending journey

As a LendFusion customer, you get access to a borrow portal, which provides 24/7 self-service support for your customers.

4. Leveraging Analytics and Machine Learning Technologies

In the lending sector, analytics and machine learning have emerged as invaluable resources.

These technologies are integrated into loan management software to predict future trends in loan performance. By analyzing patterns from historical data, this software can forecast likely outcomes, such as the risk of default or late payments.

These technologies employ AI algorithms to scrutinize a range of data from loan applications and financial records, like income and job status. This analysis helps in spotting patterns, identifying potential risks, and uncovering fraud instances. Not only does this empower lenders with well-informed decision-making, but it also boosts the loan management system’s overall efficiency.

Trend Analysis and Predictive Modeling

Loan management software offers several benefits with analysis and predictive modeling, including:

- Harnessing the power of trend analysis and predictive modeling

- Assisting lenders in identifying potential risks

- Optimizing loan portfolios

- Making informed lending decisions

For instance, predictive models use borrower data, credit history, income, employment status, and other relevant factors to forecast the probability of loan default or repayment.

This helps lenders make well-informed decisions regarding loan approvals, interest rates, and loan terms, thereby optimizing efficiency and reducing risks.

Fraud Detection and Risk Mitigation

Considering the significant risk in the lending industry, it is critical to prioritize fraud detection and risk mitigation. Advanced analytics in loan management software enable lenders to mine sensitive data, identify red flags and take proactive measures to protect their business.

Machine learning technologies can:

- Analyze various data points from loan applications

- Identify patterns

- Detect potential risks

- Reveal instances of fraud

These technologies effectively highlight red flags that require attention, allowing lenders to protect their operations from fraudulent activities.

For example, LendFusion’s decision engine provides you with insights into your loan portfolio, helping you to make better decisions about lending and risk management. This includes features such as credit scoring, risk analysis, and reporting.

5. Reducing Operational Costs and Increasing Profitability

Loan management software can significantly transform your business by:

- Reducing operational costs

- Boosting profitability

- Automating manual tasks

- Eliminating redundant tasks

- Decreasing the likelihood of human error

By utilizing loan management software, businesses can streamline their operations and improve their cash flow and overall efficiency.

Best of all:

Loan management software plays a crucial role in optimizing loan portfolio management. It tracks payments, defaults, and errors, allowing lenders to make informed decisions and improve their return on investment.

Optimizing Loan Portfolio Management

For any lending business to succeed, it’s important to optimize loan portfolio management.

Loan portfolio management involves:

- Monitoring payments, defaults, and errors

- Payment processing

- Risk assessment and mitigation

- Monitoring delinquency rates and default rates

- Implementing strategies to manage credit risk exposure

By effectively managing your loan portfolio, you can ensure the success and profitability of your lending business.

Effective strategies for enhancing loan portfolio management include:

- Regular assessment and monitoring of credit risk

- Diversification of the loan portfolio

- Implementation of concentration risk management

- Setting limits

- Continual analysis and adaptation of the portfolio in response to market conditions and evolving risk profiles

These strategies not only ensure effective management of risks associated with loan portfolios but also contribute to the overall profitability of the lending business.

Customer story: Evergreen

Here’s what Kristjan Tolmets, CEO at Evergreen.ee and LendFusion customer has to say about the benefits of loan management software:

Conclusion

Loan management software has revolutionized the industry.

It provides numerous advantages, from making loan processes more efficient and boosting data security, to enhancing the customer experience and harnessing the power of analytics.

By reducing human error and refining the loan portfolio with a high-quality loan management system, it assists lenders in cutting operational costs and boosting profitability.

As someone deeply experienced in the industry, I’ve seen the remarkable impact of loan management software and its potential to shape the future of lending.

Ready to take the next step?

Discover the impact of loan management software first-hand.

Schedule a demo with LendFusion and see how it can streamline your operations, improve your data security, elevate the customer experience, and help you grow your lending business.

Lenders also ask

How can businesses effectively train their staff to utilize loan management software to its full potential?

Businesses can effectively train their staff to use loan management software by developing comprehensive training programs that include hands-on sessions, user manuals, and ongoing support channels.

Incorporating regular updates on software features and best practices into the training ensures that staff remain adept at leveraging the software’s full potential.

What security measures should companies look for in loan management software to ensure data protection?

Companies choose a loan management software with robust security features such as end-to-end encryption, multi-factor authentication, regular security audits, and compliance with financial industry standards like PCI DSS and GDPR.

These measures ensure the protection of sensitive data against unauthorized access and breaches.

How does the implementation of loan management software impact the overall customer satisfaction and retention rates?

The implementation of loan management software significantly enhances customer satisfaction and retention rates by streamlining lending operations – loan application and management processes, ensuring timely and accurate communication, and providing personalized loan options and services.

This leads to a more efficient, transparent, and customer-friendly experience, which increases trust and loyalty among borrowers.

Andres Valdmann, CEO

Andres is the Chief Executive Officer at LendFusion. Andres has 15 years of experience in fintech and loan management software and has a proven track record in helping companies hit their growth goals.

Connect with Andres on LinkedIn.