How LMS Technology is Revolutionizing Loan Portfolio Management

Loan portfolio management has become a lot more manageable for CEOs of lending businesses in recent years.

Whether it’s ensuring compliance with ever-changing regulations, mitigating risk, or optimizing loan performance, you need a solution that can handle it all.

Enter: Loan management software (LMS).

Loan management software functional depth for established lenders, enabling effective lease and loan servicing.

By adopting loan management systems, lenders can gain a competitive edge through streamlined operations, improved risk management, and a superior customer experience.

In this article, we deep dive into how LMS refines risk and compliance processes and delivers unmatched operational efficiency to your lending practices.

Let’s get started.

The Impact of Loan Management Software on Your Portfolio

Loan management software provides real-time monitoring, a key feature that significantly enhances loan portfolio management software.

The ability to track loan applications in real-time reduces the turnaround time, thereby improving customer satisfaction.

Leveraging loan automation tools in your business can have a transformative effect on your portfolio management strategies.

These tools provide actionable insights, enabling informed decision-making in loan portfolio management.

This enables you to make strategic adjustments to your loan portfolio, ensuring optimal performance and profitability.

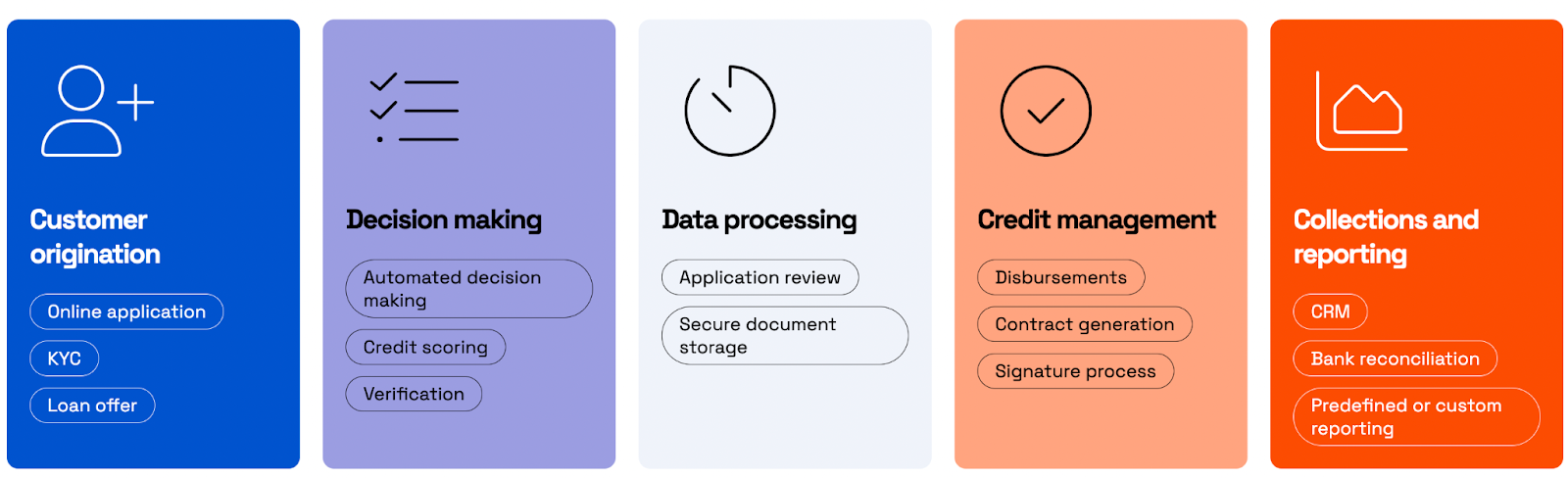

Streamlining Loan Origination and Servicing

Streamlining loan origination and loan servicing processes is another way loan management software can enhance your business operations.

Here are some benefits of using loan management software:

- Automated workflows save time and improve accuracy

- Increased efficiency and productivity

- Reduced labor costs

- Enhanced accuracy and quality of document processing

- Faster underwriting approvals

- Improve operational consistency

Imagine the time and cost savings you can achieve by implementing automated loan origination systems?

Another benefit:

We all know that customer experience is key to business growth.

Loan management platforms – like LendFusion – improve customer experience by enhancing communication through text messaging for updates on application status, payment deadlines, and other important information.

This level of communication not only improves customer satisfaction but also boosts your business’s reputation in the market.

Enhancing Risk Assessment and Compliance

Risk assessment and compliance form a critical part of loan portfolio management.

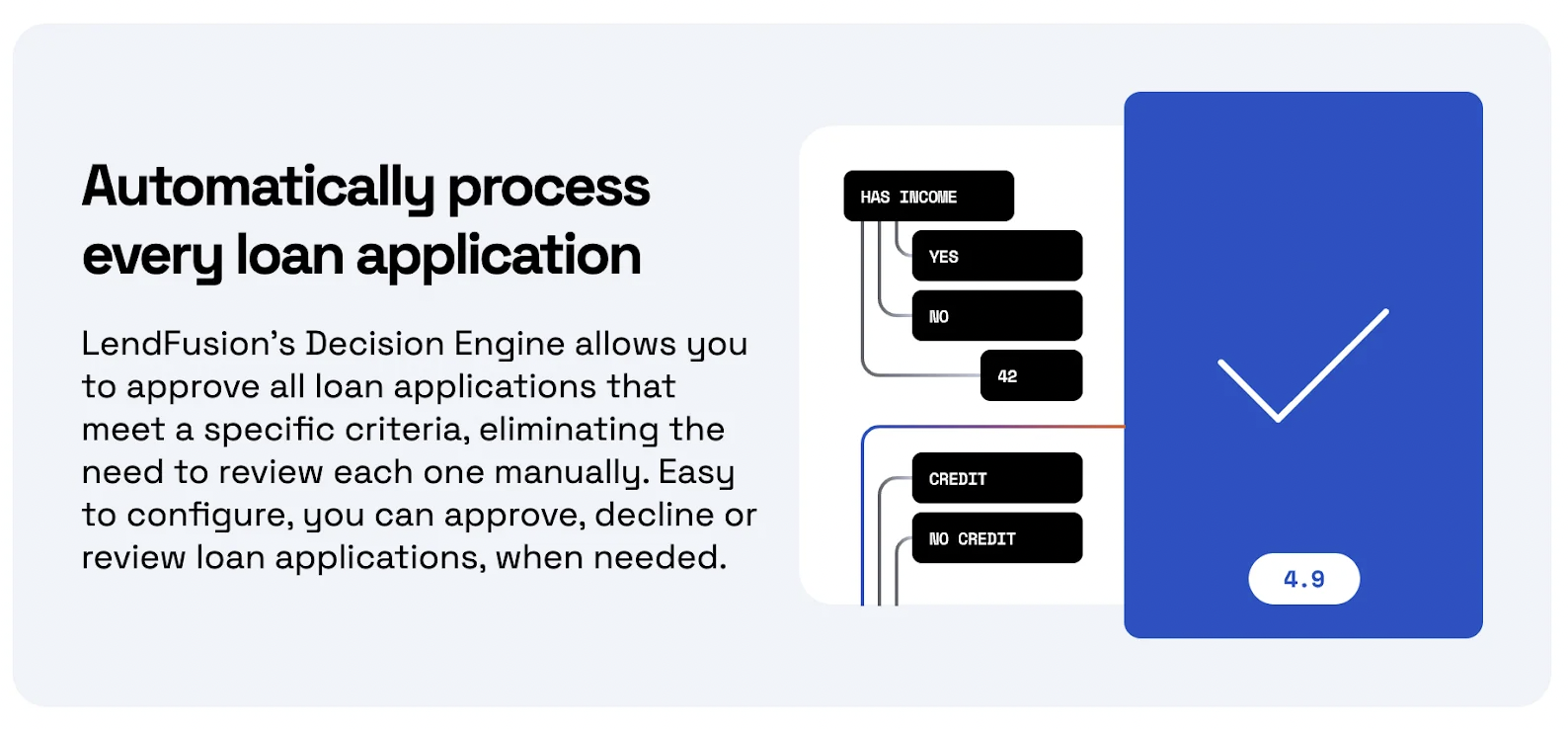

Loan management systems now utilize advanced algorithms and real-time data analytics to create comprehensive borrower profiles, improving the quality of credit assessments.

Accuracy is central to this system, which aids in risk management and the reduction of lenders’ risk exposure.

Moreover, loan management systems offer the following benefits:

- Facilitate better compliance with lending regulations through automated checks and timely integration with external databases

- Enable financial institutions to leverage big data for predictive analysis in credit risk assessment, enabling them to forecast future trends and tailor offers to individual customer needs

- Enhance business efficacy and boost customer satisfaction by implementing a robust management system

Navigating the Challenges of Late Payments and Collection

Late payments is one of the biggest loan management challenges, often resulting in increased financial risks and operational inefficiencies.

However, loan management software incorporates proactive debt collection strategies such as automated reminders and borrower traceability to minimize the incidence of bad debt.

Let’s explore how automated payment reminders and billing, along with real-time account information, can provide a proactive approach to managing late payments and collections.

Automated Payment Reminders and Billing

One of the most effective ways to improve payment compliance is through the use of automated payment reminders and billing.

Loan management systems feature efficient repayment tracking and automated payment reminders, improving transparency and enhancing the customer experience.

These automated reminders sent via SMS help improve payment compliance by providing timely prompts, thereby supporting consistent cash flows.

Plus, these reminders aid borrowers in managing their financial commitments, preventing late fees and negative credit implications by reminding them of upcoming payment deadlines.

Integrating with third-party services can further enhance the automation of processes such as debt collection and payment reminders, ensuring greater efficiency in loan portfolio management.

Real-Time Account Information for Proactive Management

Loan Servicing Software provides real-time account management, enabling efficient tracking of loan balances, interest rates, and payment histories.

This key feature allows both borrowers and lenders to proactively manage their loans, leading to improved customer satisfaction and reduced financial risk.

Proactive management through up-to-date account information helps in addressing late payments promptly, preventing potential escalation of issues.

This real-time data access empowers lenders to provide timely assistance to borrowers, fostering a positive relationship between the two parties.

Unlocking Operational Efficiency with Automation and Integration

Automation and integration are the keys to unlocking operational efficiency.

They streamline the end-to-end lending process, enabling complete management from initial quotation to asset disposal.

Let’s take a closer look at how loan processes can transform from manual to automated and how seamless integration with existing business systems can enhance operational efficiency.

From Manual to Automated: Transforming Loan Processes

Automation is the future of loan processes.

Loan management software offers several benefits, including:

- Automating manual processes such as payment schedules and interest calculations

- Reducing the need for manual processing, enhancing efficiency and profitability

- Preventing data duplication and inconsistencies, which streamline the application process by using existing customer information

- Saving time and ensuring accurate data

In addition, automated loan processes offer several benefits:

- They eliminate human errors made from manual calculations in Excel

- They automate routine tasks, freeing staff to concentrate on other business-centric activities, thus boosting overall productivity.

- They provide centralized data storage, which expedites loan processing by swiftly providing access to borrower information, further improving productivity.

Seamless Integration with Existing Business Systems

Imagine having a system that seamlessly integrates with your existing business systems, providing a scalable and uninterrupted service.

Loan management software integration with accounting, credit scoring systems, and communication platforms enhances overall functionality.

Automated loan origination and processing centralize end-to-end management of the lending process.

That’s noy all.

Cloud integration offers the following benefits:

- Effortless access to and sharing of critical reports

- Streamlined operations

- Improved collaboration within the organization

- Enhanced performance

The Role of User Training in Maximizing Software Utilization

Effective user training plays a pivotal role in maximizing software utilization.

It enhances staff members’ ability to fully leverage the capabilities of loan management software, leading to more efficient loan portfolio management.

Let’s explore how tailored training programs for different user levels and continuous support and learning resources can ensure efficient software usage.

Tailored Training Programs for Different User Levels

Customized training programs, tailored for users with different levels of expertise, ensure that everyone can use the software efficiently, regardless of their prior knowledge or experience.

Role-based training is designed to address the specific responsibilities and requirements of users at different positions within an organization, providing them with targeted knowledge and skills.

Effective training incorporates:

- Real-life scenarios that are directly relevant to the users’ day-to-day tasks

- Active incorporation of participant feedback to remain aligned with team goals and improve future sessions

- Evaluation of success using key performance indicators

- Long-term impact assessments to continuously refine and improve the training process

- Increased customer satisfaction and efficient issue resolution.

→ In the market for a new LMS? Read this post on how to choose the right platform.

Continuous Support and Learning Resources

In digital lending, ongoing support and learning resources are essential.

Software vendors offer ongoing support and resources to ensure users are always equipped with the latest technological advancements and best practices.

Tailored training programs are implemented by conducting a thorough needs assessment to pinpoint skill gaps and learning objectives, creating engagement and securing team buy-in for effective learning.

Advantages of Data-Driven Decision Making in Loan Portfolio Management

Making decisions based on data is a significant advantage for managing loan portfolios.

It enhances decision-making by forecasting market trends and understanding customer behavior, which supports more informed investment decisions.

In the following subsections, we will look into how harnessing actionable insights and real-time monitoring can facilitate strategic planning and dynamic portfolio adjustment.

Harnessing Actionable Insights for Strategic Planning

Loan management software leverages advanced analytics for risk mitigation and predictive forecasting of loan defaults, facilitating strategic risk management.

Robust and meaningful analytics empower lenders to monitor and share critical loan performance data, supporting strategic planning.

The customizable reporting capabilities of loan management software allow for the detailed evaluation of loan product profitability, enhancing strategic decision-making.

Data points provided by loan monitoring systems help lenders adapt their strategic approaches by identifying emerging risks and discovering new opportunities.

For actionable insights, technologies with key features that extract relevant data and present it in a comprehensive format for analysis are essential.

Real-Time Monitoring for Dynamic Portfolio Adjustment

Real-time monitoring empowers lenders to track portfolio progress, accelerate performance, and swiftly identify and address issues as they arise.

Access to real-time data from ongoing monitoring and risk assessments allows for the rapid management of portfolio exposures and concentrations, taking into account factors like industry, loan type, and geography.

Sophisticated data analytics and continuous risk reviews facilitate dynamic portfolio adjustments in response to market changes or internal performance metrics.

Loan monitoring systems that offer real-time data enable lenders to quickly respond to new credit requests and proactively propose solutions tailored to borrowers’ future needs.

Conclusion

Advanced loan management software is no longer “nice to have”.

It’s a business requirement for CEOs of lending businesses.

It addresses their biggest challenges, streamlines loan origination and servicing, enhances risk assessment and compliance, and provides solutions to late payments and collections.

Best of all:

It unlocks operational efficiency with automation and integration, maximizes software utilization through effective user training, and leverages data-driven decision-making for strategic planning.

Ready to improve loan portfolio management?

LendFusion’s loan portfolio management feature is designed for lenders, just like you, to achieve more, with less. Book a demo of LendFusion today to manage the entire lending process – from loan origination to loan servicing.

Andres Valdmann, CEO

Andres is the Chief Executive Officer at LendFusion. Andres has 15 years of experience in fintech and loan management software and has a proven track record in helping companies hit their growth goals.

Connect with Andres on LinkedIn.