Why Loan Reporting and Analytics Are Essential for Strategic Decision-Making and Business Growth

In loan management, nothing beats the clear insights provided by good loan reporting and analytics.

By turning raw numbers into useful information, lenders can make smart decisions to manage risks and improve their services.

Imagine being able to predict borrower behavior, forecast how loans will perform, and streamline lending operations, all from one platform.

That one platform? It’s Loan Management Software (LMS).

Loan management software isn’t just a tech upgrade…

…it’s a strategic advantage that can change the future of your business.

Picture this:

Your decisions are backed by precise analytics that spot trends early, where your team focuses on personalized service rather than sifting through data, and managing loans in Excel.

Ready to learn more about how loan management systems reshape lending with precise analytics that can help you achieve your business goals?

Let’s dive in.

Harnessing the Power of Loan Management Systems for In-Depth Reporting

Loan management software is more than a database of borrower data; it’s the engine that drives strategic decision-making, risk assessment, and loan performance monitoring.

With robust reporting tools at your fingertips, you can distill vast amounts of data into meaningful insights, enabling data-driven decision-making for lenders to tailor their approaches and refine their lending business practices.

The Role of Real-Time Data in Loan Management

Harnessing real-time data provides clear, immediate insights for your lending strategies.

These insights empower lenders to act swiftly, implementing proactive measures to mitigate risks before they can escalate.

In addition, real-time analytics are the backbone of early warning systems, integral to the proactive mitigation of loan risks.

By continuously monitoring loan portfolios, lenders can identify subtle shifts in borrower behavior, allowing for early intervention and the preservation of loan portfolio health.

Crafting Custom Reports for Strategic Insight

Custom reports allow lenders to examine specific aspects of their lending operations closely.

By configuring custom reports to meet unique analytical needs, lenders can dissect their operations, identifying trends and opportunities with precision.

Business intelligence plays a crucial role in transforming these insights into actionable strategies.

Such strategic use of data analytics and custom reporting is not a luxury but a necessity in the competitive landscape of lending software.

Think of it this way:

It is the difference between a one-size-fits-all approach and a bespoke strategy that aligns with a lender’s specific business goals, driving growth and operational excellence.

Integrating Analytics Capabilities for Enhanced Loan Servicing

Advanced analytics, including predictive models, can transform loan management systems from passive data repositories into dynamic tools for strategic foresight.

By analyzing borrower data and financial patterns, lenders can not only personalize loan offerings but also enhance borrower satisfaction, fostering loyalty and retention.

Predictive models and machine learning algorithms act as a sophisticated risk assessment toolkit within your loan software, offering a comprehensive view of potential risks.

This allows lenders to navigate the intricacies of borrowers’ financial situations with greater accuracy, ensuring the stability and health of their loan portfolios.

Predictive Analytics: Anticipating Borrower Risks

Predictive analytics in loan management anticipate future outcomes, helping lenders stay ahead.

By leveraging historical data and advanced machine learning algorithms, lenders can perform nuanced risk assessments, preparing for various scenarios before they unfold.

These algorithms are adept at spotting complex patterns, enabling lenders to detect early signs of repayment issues, thereby mitigating potential defaults.

The valuable insights provided by predictive modeling are invaluable, offering a foresight into borrower behavior that informs proactive lending strategies.

Lenders can thus anticipate market changes and borrower needs, tailoring their services to stay ahead of the curve.

Visual Analytics: A Picture of Loan Health

Data visualization and visual analytics turn complex loan data into an easy-to-understand visual journey of your loan’s status.

With these tools, lenders obtain a panoramic view of their portfolios, enabling them to:

- Spot trends and anomalies at a glance

- Quickly identify the status and performance of loans

- Make timely and strategic decision-making

- Remain agile and responsive

These visual tools also provide data-driven insights that enhance the decision-making process.

The relevance of data visualization in loan servicing cannot be overstated.

It varies depending on the type of loans, customer profiles, and business operations, but the end goal remains the same: to offer lenders a clear and comprehensive view that informs strategic decisions and nurtures portfolio growth.

Key Performance Indicators (KPIs) Lenders Should Monitor

Success is measured through metrics. Financial dashboards and key performance indicators (KPIs) are used to gauge loan portfolio performance.

Financial dashboards within loan management systems turn complex data into concise summaries, providing lenders with a clear view of their financial health and allowing for swift, strategic adjustments.

Lenders who keep a keen eye on KPIs such as loan approval rates, default rates, and portfolio yields are better equipped to maintain profitability and operational efficiency.

Monitoring these KPIs is not just about keeping score; it’s a strategic exercise that aligns operational activities with business goals.

By understanding and responding to these metrics, lenders can enhance their lending strategies, mitigate risks, and secure their place in a competitive market.

From Interest Rates to Overdue Amounts

Interest rates, loan terms and credit limits.

These are the triad of lending metrics that every lender must master.

By assessing these KPIs through the lens of integrated data, lenders can sharpen their lending strategies and make more informed decisions. Some key lending metrics to consider include:

- Interest rates: The rate at which borrowers are charged for borrowing money.

- Loan terms: The length of time borrowers have to repay their loans.

- Credit limits: The maximum amount of credit that a lender is willing to extend to a borrower.

These metrics are crucial for informed decision-making, helping lenders to understand the return on their loan products and adjust their strategies accordingly.

Streamlining Loan Applications and Borrower Data

Streamlining loan applications and borrower data management is pivotal in enhancing the lending business’s productivity and customer satisfaction.

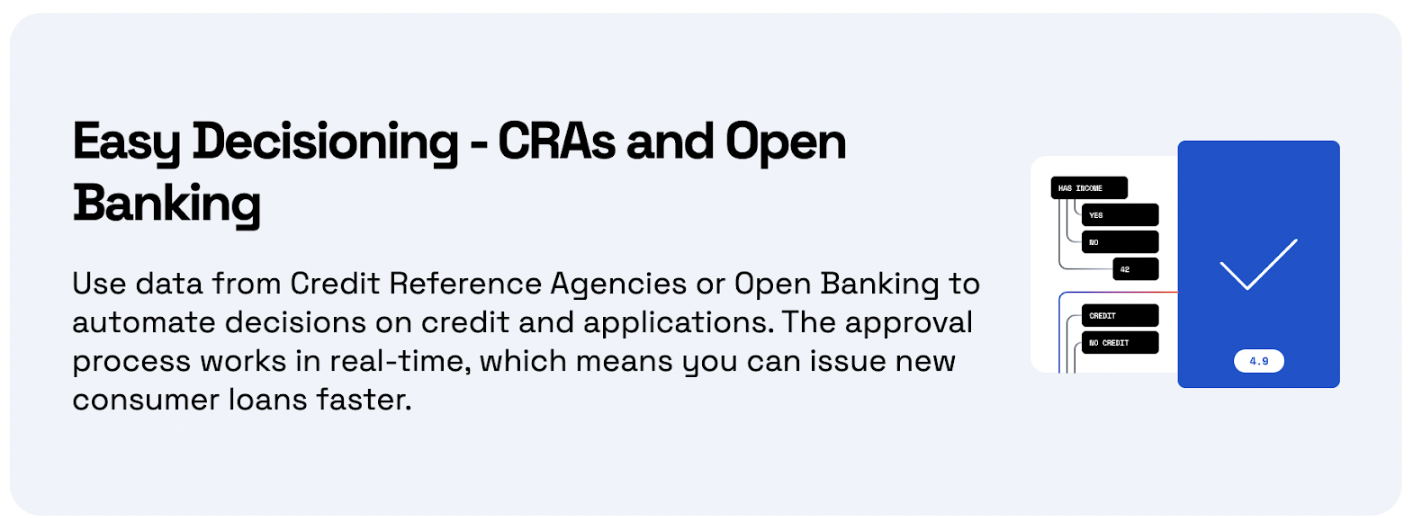

By integrating with credit bureaus and leveraging comprehensive data analytics, loan management software offers a complete view of borrowers’ financial standing, speeding up the loan approval process and improving service quality.

Some benefits of loan management software include:

- Streamlining loan application process

- Faster loan approval process

- Improved service quality

- Enhanced customer satisfaction

Automated platforms – like LendFusion – offer several benefits, including:

- Filtering out unqualified applications

- Expediting the collection and underwriting processes

- Accelerating approvals

- Elevating the borrower experience

- Efficient verification of borrower information through integration with external data sources

- Commitment to operational excellence and data accuracy

Enhancing Borrower Experience through Efficient Data Management

Efficient management of borrower data is a critical pillar in fostering customer satisfaction and loyalty.

Loan management systems enhance the borrower experience by:

- Making information more accessible

- Making services more responsive

- Making technology more user-friendly

- Providing automated reminders (i.e. repayment tracking)

- Offering flexible payment options

These features contribute to a seamless borrower journey, reflecting positively on customer satisfaction and retention rates.

The commitment to efficient data handling extends beyond borrower satisfaction; it is a strategic move that can drive growth and secure a loyal customer base.

By making more informed decisions and providing a personalized service, lenders can differentiate themselves in a crowded marketplace, solidifying their reputation as customer-centric companies.

Optimizing Business Operations with Automated Loan Management Features

Loan management software features streamline invoicing and payment processing, ensuring every transaction is timely and accurate.

These systems not only reduce manual labor but also enhance productivity, accelerating decision-making through the use of advanced analytics and operational efficiencies.

Regulatory compliance is a non-negotiable aspect of the lending industry, and automated loan management systems are invaluable allies in this regard.

By managing regulatory checks, taxes, and fraud detection processes, these systems help lenders comply with industry regulations, ensuring peace of mind and maintaining business integrity

Navigating Loan Types and Terms with Advanced Reporting Tools

The variety of loan products in the lending industry, such as revolving credit facilities, requires advanced reporting tools that are both adaptable and insightful.

Loan management software meets this need with a wide range of tools designed to accommodate everything from standard term loans to complex revolving credit facilities.

These advanced reporting capabilities allow lenders to dissect loan data according to various terms, such as interest rate types and repayment schedules, providing actionable insights that inform risk management and portfolio expansion strategies.

Understanding the nuances of different loan types and terms is crucial, as they dictate the nature of the reports generated and the insights derived.

The strategic use of these advanced reporting tools equips lenders with the knowledge to make informed decisions and seize growth opportunities.

Tailoring Analytics for Different Loan Products

Customizable analytics allow lenders to tailor their approach to cater to diverse loan products, effectively segmenting customers and offering personalized solutions.

Automated solutions enhance loan servicing by accommodating variations in loan products (i.e. consumer loans or commercial loans), shifting the focus from manual tasks to strategic decision-making.

These data analytics tools empower lenders to segment their customer base effectively, providing personalized loan products that meet the unique financial needs of different borrower segments.

This level of customization not only benefits the borrower but also enhances the lender’s ability to manage risk and maximize profitability. Ultimately, that’s what matters most.

Conclusion

Loan reporting and analytics in loan management software is essential for business success.

Using tools like real-time data and predictive analytics helps lenders make smart decisions, improve their processes, and offer a better experience for borrowers.

Moving forward, new technologies like machine learning and artificial intelligence will continue to transform the industry, making decision-making faster and more accurate.

Speed wins in business.

The faster you can use data to improve your strategy, the faster you will grow.

Ready to Upgrade Your Loan Reporting and Analytics?

See how LendFusion can improve your loan reporting and analytics.

Book a demo today to see firsthand how our loan management software can enhance your decision-making, streamline your operations, and improve borrower satisfaction.

Book a Personalized Demo of LendFusion

Vahuri Voolaid, COO

Vahuri is the Chief Operations Officer at LendFusion. Vahuri has 8 years of experience in fintech with loan management software as a product owner and an MBA with a specialisation in IT management.

Connect with Vahuri on LinkedIn.