How Lenders Are Using Loan Performance Tracking to Drive Business Growth

Leveraging technology is the one thing that successful lenders have in common.

Loan management software provides real-time tracking of loan portfolios, enabling lenders to automate processes and gain actionable insights that enhance both operational efficiency and customer satisfaction.

A key component is loan performance tracking.

Loan performance tracking is essential for managing risk, making data-driven decisions, and improving the overall health of loan portfolios.

By leveraging automation and cloud-based solutions, lenders can streamline management tasks, improve accuracy and efficiency.

In this article, we look at the importance of loan performance tracking and how it can help transform the way lenders monitor and manage their portfolios.

Ready?

Let’s dive in.

Importance of Loan Performance Tracking

Effective loan performance tracking is the cornerstone of successful loan management, providing lenders with the tools to manage risk and make informed decisions.

Monitoring key performance metrics like delinquency rates and loan payments offers valuable insights into loan portfolios and loan status, helping to identify potential issues before they escalate.

Strategic reporting tools are vital for generating insights from loan performance data, essential for compliance and planning.

Accurate and timely data allows financial institutions to fine-tune their lending strategies, ensuring competitiveness and regulatory compliance.

Tracking loan performance enables lenders to make data-driven decisions, fostering success in lending practices.

This improves the health of loan portfolios and enhances the ability to serve customers effectively, leading to better business outcomes.

Key Metrics for Loan Performance

Monitoring key metrics is crucial for effective loan performance tracking.

One critical metric is the delinquency rate, indicating the proportion of overdue loans.

This helps lenders manage credit risk by identifying loans that may require intervention.

The default rate, representing loans not repaid after a set period, is another important metric.

High default rates indicate significant risk and can affect the financial stability of lending institutions. Monitoring default rates allows lenders to take proactive measures to mitigate potential losses.

Tracking repayment schedules is equally important.

Regular assessment provides insights into cash flow and the overall stability of loan portfolios. Tracking these metrics ensures loan portfolios remain healthy and sustainable, allowing for informed lending decisions and optimized operations.

Leveraging Automation for Loan Performance Monitoring

Automation is transforming loan performance management.

Implementing loan management software enhances efficiency by automating tasks and centralizing data. This streamlines the entire loan lifecycle, from loan applications to approval, improving speed and accuracy.

Automated workflows in loan servicing reduce manual errors and optimize the loan management process.

Minimizing manual tasks allows users to focus on higher-value activities like customer service and strategic planning, leading to improved operational transparency and better financial outcomes.

Automation minimizes human errors in loan management, particularly in tasks like document management and data entry.

It saves time and reduces the likelihood of mistakes, ensuring loan servicing tasks are completed accurately and efficiently.

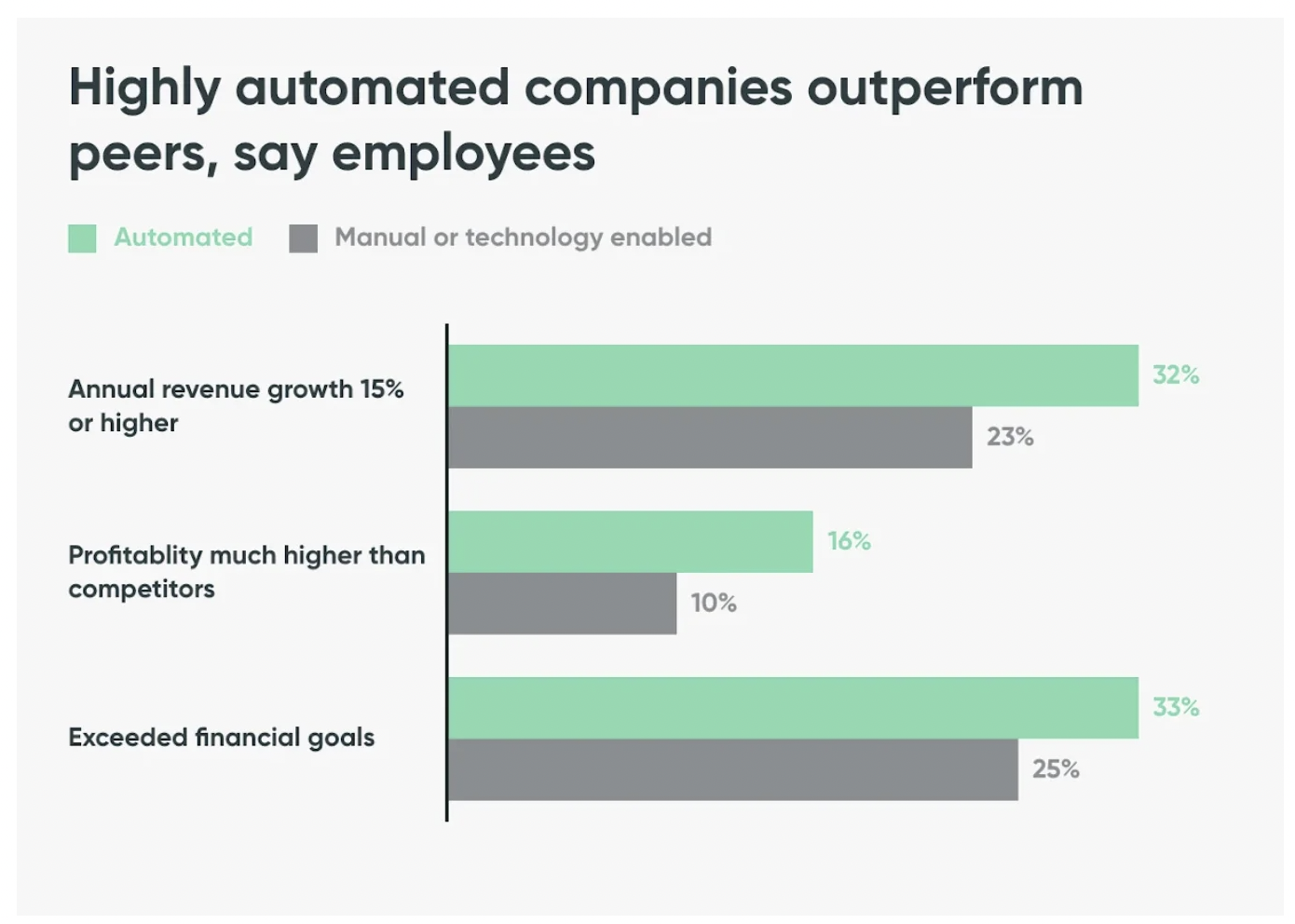

In fact, lenders that embrace loan management automation witness a significant boost in their financial performance, with a reported 15-20% increase in annual revenue.

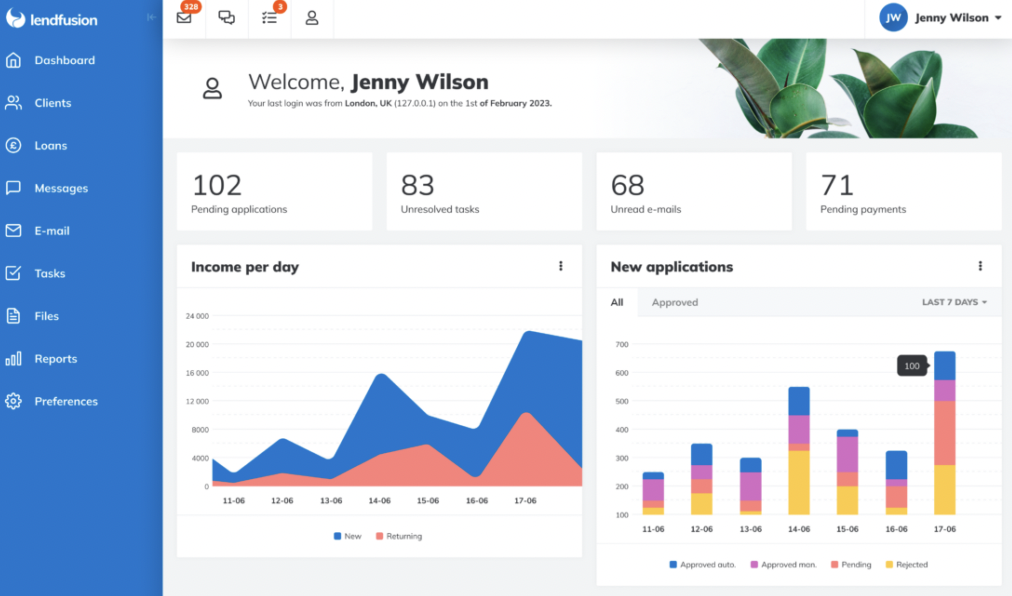

Loan management software enhances operational transparency by providing real-time access to performance data.

This allows lenders to monitor loan performance closely and make timely adjustments to their strategies.

Leveraging automation in loan performance monitoring significantly improves efficiency, accuracy, and customer satisfaction.

In addition, commercial lending software – and other types of loans – can further streamline these processes.

Real-Time Insights with Integrated Analytics

Real-time insights are invaluable for established lenders.

Loan management systems with integrated analytics provide updates that foster better risk management and decision-making.

This allows lenders to anticipate customer needs and tailor services for a personalized experience.

Analyzing customer behavior and loan performance data helps lenders discover cross-selling opportunities, such as refinancing options, aligning products with client needs.

This improves customer satisfaction and enhances business growth.

Utilizing loan reporting and analytics allows lenders to make decisions quickly and efficiently.

Generating detailed reports and gaining insights into loan performance trends facilitate timely decision-making.

Another major benefit?

It ensures that lenders remain competitive and responsive to changing market conditions.

Enhancing Operational Efficiency with Cloud-Based Solutions

Cloud-based loan management solutions are revolutionizing the lending industry by enhancing operational efficiency and reducing costs.

Automating key lending processes allows teams to focus on broader strategic goals instead of routine tasks.

Implementing cloud solutions has led to significant improvements in loan processing efficiency and overall portfolio management.

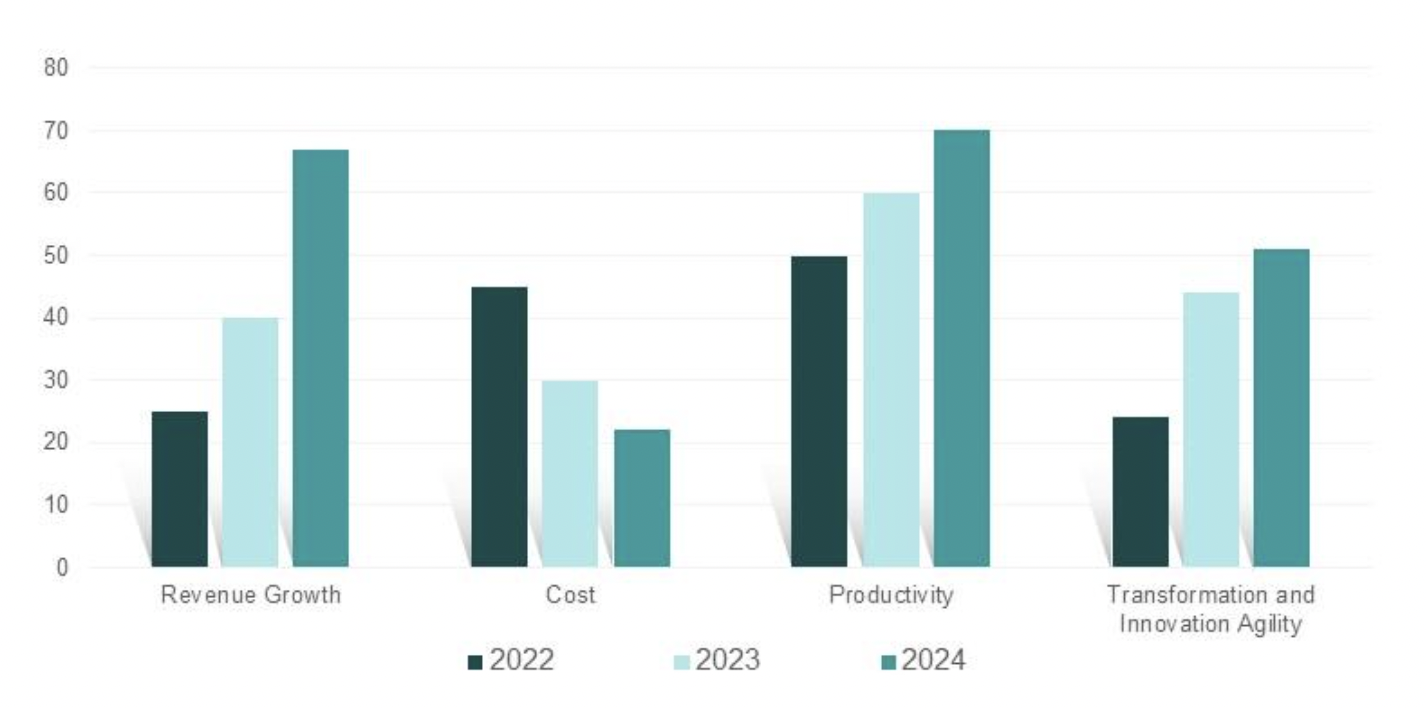

One study found that improving operational efficiency has a significant impact on revenue, cost reduction, productivity and innovation.

A major advantage of cloud-based platforms is immediate access to current borrower data, facilitating quick decision-making.

These platforms enable smooth collaboration among lenders, underwriters, and servicers by centralizing information and workflows.

This approach improves efficiency and ensures all stakeholders have access to up-to-date information.

As lending operations expand, cloud-based solutions accommodate increased workloads and data storage needs.

Robust security measures in cloud software protect sensitive loan data through encryption and regular audits.

Cloud solutions provide personalized servicing options for borrowers, enhancing engagement and satisfaction.

Loan management software features – like Custom reporting – enhance operational efficiency by automating data analysis and reducing manual entry tasks – like managing loans in Excel – allowing lenders to generate detailed reports quickly and accurately.

Customizable Reporting Tools

Customizable reporting tools drive business growth through informed decision-making.

These tools enable lenders to generate detailed reports on performance metrics and risk assessments, providing a comprehensive view of their lending business operations.

Closely examining specific operations allows lenders to gain insights that enhance decision-making.

Data visualization tools provide clear insights into loan performance trends, facilitating timely decision-making.

Reports can include daily and monthly reports, tax reports, investor statistics, customer analysis reports, and loan tracking system summaries.

Generating detailed reports helps lenders stay on top of operations and make strategic adjustments as needed.

Integrations with BI tools enhance data analysis and reporting capabilities.

These integrations ensure lenders can leverage their data’s full potential, making informed decisions that drive business growth and improve operational efficiency.

Improving Customer Relationship Management

Effective loan performance tracking enhances customer relationship management (CRM) by providing valuable insights into borrower behavior.

A well-implemented loan management system enhances customer satisfaction by offering convenient and timely communication options.

Personalized communication creates stronger relationships between lenders and borrowers, leading to improved customer loyalty and satisfaction.

Analyzing communication patterns allows lenders to proactively resolve frequent customer issues, significantly enhancing overall satisfaction.

Tailored reports based on detailed borrower behavior analysis enable institutions to implement focused lending strategies that meet specific customer needs.

This data-driven approach to customer interactions reinforces the lender-borrower relationship and ensures a positive lending experience.

Integrating loan performance tracking into customer interactions elevates the service model, fostering stronger relationships through timely, data-driven interactions.

This proactive approach improves customer satisfaction and contributes to business growth by retaining satisfied customers and attracting new ones.

Conclusion

By leveraging loan management software, like LendFusion, lenders can enhance operational efficiency, reduce human error, and make data-driven decisions that drive business growth.

Key performance metrics such as delinquency rates, default rates, and repayment schedules are essential for effective loan performance monitoring and risk management.

The integration of automation, real-time insights, and customizable reporting tools further enhances the efficiency and accuracy of loan management processes.

These technologies not only improve operational transparency but also enhance customer relationship management by providing personalized and timely communication.

Adopting these solutions will enable lenders to stay competitive, compliant, and responsive.

Ready to Upgrade Your Loan Performance Tracking?

See how LendFusion can improve your loan performance tracking.

Book a demo today to see firsthand how our loan management software can improve operational efficiency, streamline your operations, and boost borrower satisfaction.

Book a Personalized Demo of LendFusion

Vahuri Voolaid, COO

Vahuri is the Chief Operations Officer at LendFusion. Vahuri has 8 years of experience in fintech with loan management software as a product owner and an MBA with a specialisation in IT management.

Connect with Vahuri on LinkedIn.