5 Ways Real Estate Lending Software Can Grow Your Business

Are you searching for ways to improve your real estate lending process?

We can help you.

Real estate lending software can transform your operations.

With real estate lending software, you can improve operational efficiency by automating routine tasks, reducing manual workloads, and minimizing human errors.

This is crucial as the property lending market is projected to grow by 11% between 2023 and 2030, indicating increasing demand and the need for streamlined lending operations.

The software also enhances customer experience with features like faster loan approvals, online application portals, and personalized services, leading to higher satisfaction rates.

Research shows that customer satisfaction in the property lending market improves by 20% with the use of loan management software.

In addition:

Detailed loan reporting and analytics capabilities allow lenders to make informed decisions, optimize strategies, and maintain compliance while leveraging cost-saving, scalable solutions.

This article explores the 5 benefits of using real estate lending software and demonstrates how these benefits can help your business grow.

1. Improve Operational Efficiency

Automating routine processes with real estate lending software significantly reduces the manual workload, enabling lenders to focus on more strategic tasks.

This not only speeds up the loan origination process but also ensures that each step is carried out with precision and accuracy.

In an industry where time is money, the ability to process loans quickly and efficiently can give your business a competitive edge.

There are several benefits of improved operational efficiency. From converting paperwork to digital formats to streamlining complex loan origination processes, real estate lending software offers tailored solutions that can transform your business operations.

Seamless integration with existing systems further enhances this efficiency, allowing for better coordination and resource allocation.

These systems offer various ways to enhance operational efficiency.

Automation of Loan Processes

Automation is at the heart of operational efficiency in real estate lending.

Loan management systems automate every stage of the loan lifecycle, making the application process easier and faster.

From calculating interest rates and fees to processing loan payments, automated processes ensure that each task is performed accurately and efficiently.

This not only reduces the workload for lenders but also minimizes the risk of errors, leading to improved customer satisfaction.

Automated tasks allow lenders to manage a higher volume of applications without escalating operational costs.

This feature is especially advantageous for private lenders and traditional financial institutions aiming to expand their lending operations.

With the help of loan management software – like LendFusion – businesses can streamline their loan origination and automate loan origination, document management, and approval workflows, ensuring a smooth and efficient lending process.

Reduction of Human Error

One of the significant advantages of real estate lending software is its ability to reduce human error.

Manual calculations, such as EMI percentages and loan disbursement amounts, are prone to mistakes that can have costly consequences.

Loan management systems handle these complex calculations effectively, ensuring correct valuations and minimizing the risk of errors.

This is crucial for maintaining the integrity of the lending process and ensuring accurate outcomes in real estate transactions.

Furthermore, AI-enhanced loan processing solutions significantly reduce documentation errors. Minimizing human error ensures that critical deals are not overlooked, leading to higher customer satisfaction and loyalty.

Seamless Integration

Seamless integration is another key benefit of real estate lending software.

A sophisticated loan management system can connect with existing platforms, such as CRM and finance systems.

This integration allows for a unified platform for all lending operations, enhancing coordination and resource allocation.

The result is a more responsive and efficient lending process, leading to improved customer satisfaction.

Whether it’s integrating with third-party applications or customizing the software to match business processes, the flexibility offered by these systems ensures that lenders can operate more efficiently and effectively.

This not only increases operational efficiency but also supports the growth and scalability of the lending business.

2. Better Customer Experience

Providing an exceptional customer experience is crucial.

Real estate lending software plays a significant role in enhancing customer satisfaction by streamlining communication and automating documentation tasks.

These systems enable lenders to offer a more efficient and user-friendly experience in the real estate industry, which is essential for retaining customers and attracting new ones.

Several key features of lending software contribute to an improved customer experience.

From faster loan approvals to online application portals and personalized services, these tools ensure that borrowers have a smooth and enjoyable journey.

These features contribute to a better customer experience in various ways.

Faster Loan Approvals

Speed is of the essence in the real estate market…

…and faster loan approvals can make a significant difference.

Loan management systems automate repetitive tasks such as loan origination, document management, and automated workflows, leading to faster loan process times.

This not only enhances operational efficiency but also ensures that borrowers can access funds quickly, improving their overall experience with loan origination software.

Faster loan approvals lead to quicker property buying transactions and higher customer satisfaction for property owners and real estate agents.

This capability is particularly beneficial for private lenders, mortgage lenders, and traditional financial institutions looking to streamline their lending process and offer a competitive edge in the market.

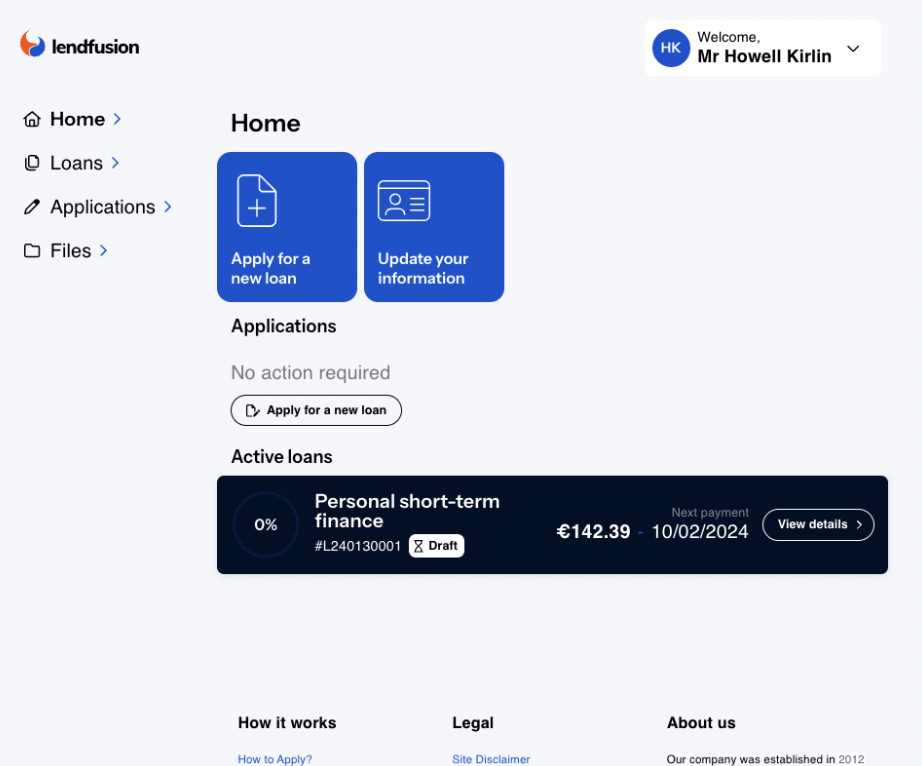

Online Application Portals

Online application portals have revolutionized the real estate lending landscape by providing a digital-first approach for borrowers.

These platforms enable borrowers to easily upload documents, monitor their application status, and track their loan progress in real-time from any device.

This level of transparency and convenience enhances the user experience and builds trust between lenders and borrowers.

Best of all:

Online portals streamline the loan application process, reducing the need for in-person visits and paperwork. This not only improves operational efficiency for lenders but also ensures that borrowers have a hassle-free experience, ultimately leading to higher customer satisfaction.

Personalized Services

Personalization is key to meeting individual borrower needs and preferences.

Real estate lending software leverages data analytics to craft personalized loan offerings based on borrower history and preferences.

By understanding customer behavior and utilizing customer data, lenders can offer tailored solutions that enhance satisfaction and loyalty.

Automating reports in real-time aids lenders in making quicker and more informed decisions related to personalized services.

This capability is particularly beneficial for real estate professionals and businesses looking to provide a more customized and engaging experience for their clients.

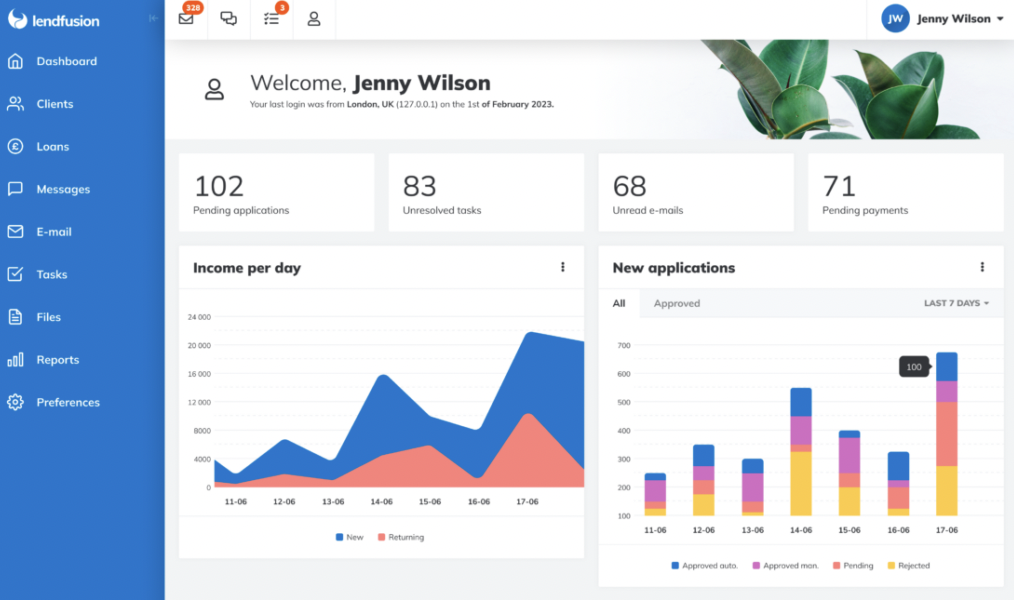

3. Detailed Reporting and Analytics

Having access to detailed reporting and analytics is invaluable.

Real estate lending software provides real-time access to key metrics, allowing lenders to make timely and informed decisions.

By automating calculations and maintaining detailed audit trails, these systems enhance accountability and simplify the audit process.

The integration of real-time data access, automated calculations, and robust audit trails creates a comprehensive reporting framework that optimizes the lending process.

From generating customizable reports to leveraging predictive analytics, lending software ensures that lenders have the insights they need to make data-driven decisions.

Real-Time Data Access

Automated decision-making tools can evaluate borrower applications in real-time, significantly reducing approval times.

LMS platforms can pull together quality data, classify it, and store it for smart reuse, enhancing data utilization.

This capability allows lenders to make informed decisions quickly, improving overall lending efficiency.

Real-time data access allows lenders to monitor key metrics and performance indicators, keeping them on top of their lending operations. This not only enhances operational efficiency but also supports better decision-making and strategic planning.

Customizable Reports

Customizable reports are essential for providing vital insights into loan performance, borrower demographics, and market trends.

Real estate lending software offers robust reporting tools and analytics capabilities that help lenders generate detailed reports reflecting current metrics and performance indicators.

Predictive analytics within the reporting framework allows lenders to forecast future lending trends and identify potential risks and opportunities.

This kind of customization provides lenders with the necessary information to make informed decisions and optimize their lending strategies.

Predictive Analytics

Predictive analytics plays a crucial role in helping lenders make data-driven decisions.

By analyzing housing market trends, economic indicators, and demographic data, AI can identify potential investment opportunities and forecast future property values.

This capability provides a significant advantage for lenders looking to mitigate risks and find high-value investment opportunities.

However, it’s important to remember that predictive analytics isn’t always perfect.

Although AI can uncover trends not readily apparent to human investors, it does not always predict reality. Accurate reports generated by predictive analytics are essential for making reliable decisions.

4. Enhanced Compliance and Security

Compliance and security are critical aspects of real estate lending.

Loan management software enhances compliance and security by providing comprehensive audit trails, data encryption, and regulatory compliance features.

These tools ensure that lenders adhere to local and international regulations, protect sensitive customer data, and maintain the integrity of the lending process.

By automating compliance processes and ensuring data security, real estate lending software offers a robust framework for managing compliance and security risks.

Regulatory Compliance

Regulatory loan compliance is crucial for lenders to avoid penalties and ensure the integrity of the lending process.

Loan management software aids lenders in maintaining adherence to both local and international regulations by providing built-in compliance features and facilitating regular updates.

These systems automate processes and provide alerts to help lenders meet regulatory requirements.

By automating compliance processes, lenders can ensure that they stay up-to-date with regulatory changes and maintain accurate records for audits. This enhances compliance while reducing the risk of regulatory penalties and legal issues.

Data Encryption

Data encryption is a critical component of data security in real estate lending.

Advanced encryption technologies effectively protect sensitive customer data both during transmission and storage.

This significantly lowers the risk of unauthorized data access and data breaches.

Implementing robust encryption techniques in loan management systems ensures that sensitive customer information is protected at all times.

This not only enhances data security but also builds trust between lenders and borrowers, ultimately leading to higher customer satisfaction.

Audit Trails

Loan audit trails are essential for promoting accountability and transparency in real estate lending.

Enhanced compliance features facilitate detailed audit trails, ensuring that all necessary records are maintained for review.

These trails track all user activities and changes within the loan management system, providing clear records for audits and compliance checks.

Ensuring data security and protection measures strengthens the integrity of audit trails, safeguarding sensitive information and maintaining the trust of stakeholders. This not only enhances compliance but also supports better decision-making and strategic planning.

5. Higher Cost Savings and Scalability

Real estate lending software offers significant cost savings and scalability benefits.

By streamlining various processes and reducing manual tasks, these systems decrease operational costs and improve profitability for real estate businesses.

Scalable software solutions enable lenders to grow their operations seamlessly and efficiently.

From reducing administrative overhead to leveraging cloud-based platforms, real estate lending software provides a robust framework for managing costs and supporting business growth.

Lower Operational Costs

A key benefit of real estate investment lending software is the reduction of operational costs.

By automating repetitive tasks such as loan origination and document management, these systems significantly reduce administrative overhead.

This not only enhances operational efficiency but also decreases paper-based processes, further reducing costs.

Cloud-based platforms further reduce IT infrastructure costs and provide operational flexibility. This is particularly beneficial for property managers and commercial property owners aiming to streamline property management processes and improve profitability.

Scalable Solutions

Scalability is a critical feature for any growing business, and real estate lending software is designed to be flexible and adaptable.

Lending systems are built to service different types of loans, providing the flexibility needed to manage various financial products effectively.

This capability ensures that lenders can adjust to the evolving needs of financial institutions and accommodate increased loan volumes as their business expands.

Implementing scalable software solutions allows lenders to reduce loan management challenges and ensure efficiency and growth as loan demands increase.

Seamless integration and tailored solutions allow lenders to operate more efficiently and effectively, supporting long-term business growth and success.

Cloud-Based Platforms

The use of cloud-based platforms in real estate lending is transforming the industry by offering scalable and cost-effective solutions.

Cloud infrastructure enhances scalability and reduces IT costs, enabling lenders to focus on their core operations without worrying about maintaining expensive hardware.

This flexibility is particularly beneficial for remote sales personnel, who can access necessary tools and data from anywhere, improving productivity and responsiveness.

Cloud-based platforms also provide seamless integration with existing systems, ensuring smooth and efficient operations. By leveraging cloud technology, lenders can reduce operational costs and enhance flexibility, ultimately leading to improved operational efficiency and business growth.

Conclusion

There’s no doubt:

Real estate lending software will revolutionize your business operations.

From enhanced operational efficiency and improved customer experience to detailed reporting and analytics, these tools provide a comprehensive solution for managing loans effectively.

By leveraging automation, reducing human error, and ensuring seamless integration, lenders can significantly improve their efficiency and customer satisfaction.

The benefits don’t stop there:

The advanced compliance and security features of these systems ensure that lenders adhere to regulations and protect sensitive customer data.

But none of this matters if it doesn’t help grow your business, right?

The good news is that it does.

When you invest in real estate lending software, the cost savings and scalability you get in return support long-term business growth and profitability.

Ready to Transform Your Property Lending Process?

Discover how LendFusion can upgrade your real estate lending operations. Our loan management platform is designed for lenders, just like you, to enhance operational efficiency, improve customer experience, and ensure compliance and security.

Don’t miss out on the opportunity to streamline your processes and stay ahead in the competitive real estate market.

Book a personalized demo and see LendFusion in action today!

Andres Valdmann, CEO

Andres is the Chief Executive Officer at LendFusion. Andres has 15 years of experience in fintech and loan management software and has a proven track record in helping companies hit their growth goals.

Connect with Andres on LinkedIn.