3 Ways Loan Management Software Streamlines Loan Compliance

If there’s one word that connects with business and lending, it’s compliance.

It’s a critical aspect for lenders, ensuring they adhere to regulatory requirements.

Loan Management Software (LMS) plays a vital role in achieving compliance by automating processes, providing real-time alerts, and generating detailed audit trails.

In this article, we will explore how leveraging loan compliance with loan management software can enhance compliance and operational efficiency.

The Importance of Loan Compliance in Lending

Regulations are designed to protect both lenders and consumers.

Non-compliance can have severe repercussions.

For example, lenders face potential penalties including fines, public announcements, and even criminal prosecution if they fail to adhere to lending regulations.

Given that new regulations are enacted worldwide each business day, staying compliant is a constantly evolving challenge in loan management.

Understanding the importance of compliance is the first step. It not only helps in mitigating risks but also in fostering a reliable and transparent environment.

For lenders, it’s about more than just ticking boxes:

It’s about building and maintaining trust and efficiency in their lending operations.

3 Key Features of Loan Management Software for Compliance

Loan management systems have emerged as a powerful tool for lenders.

These systems are designed to streamline processes, ensure transparency, and enable prompt corrective actions. Key features such as automated reporting, audit trails, and compliance alerts make it easier to adhere to both internal policies and legal regulations.

When integrated into a comprehensive loan management system, these features not only enhance efficiency but also significantly reduce the risk of non-compliance.

Let’s delve deeper into these core functionalities to understand how they contribute to a seamless compliance strategy.

1. Automated Reporting

Automated reporting in loan management platforms offer several benefits, including:

- Reducing the need for manual data entry and processing, minimizing errors and saving time

- Automating compliance checks, ensuring that all reports are cross-verified against the latest local regulations

- Expediting the compliance review process

These features are crucial for maintaining up-to-date records and avoiding discrepancies.

Through automation, lenders can focus more on strategic decisions rather than getting bogged down in manual tracking of regulatory changes.

This not only boosts efficiency but also ensures that compliance is always a step ahead.

2. Audit Trails

Loan audit trails are vital for transparency and accountability within a loan management system.

By tracking all changes and actions, these trails provide a detailed record that is indispensable during regulatory audits.

This comprehensive record-keeping ensures that every modification is documented, enhancing both internal controls and compliance outcomes.

3. Compliance Alerts

Compliance alerts are another critical feature of loan management software.

These real-time notifications alert users to potential compliance issues, allowing for immediate corrective actions. By addressing these issues promptly, institutions can prevent minor problems from escalating into major regulatory breaches.

Continuous monitoring through compliance alerts offers several benefits:

- Ensures that no compliance issue is overlooked

- Helps in maintaining adherence to regulations

- Minimizes risks associated with non-compliance

- Provides a robust strategy for staying compliant in a dynamic regulatory environment.

Integration with Core Systems and Credit Bureaus

Seamless integration of loan management software with core systems and credit bureaus is essential for ensuring data accuracy and operational efficiency in the lending business.

This integration allows for automated and streamlined loan origination and loan servicing, which includes real-time updates and data transfer.

Such capabilities are crucial for maintaining a consistent flow of accurate information, which is foundational for compliance and effective customer relationship management.

Another advantage:

Integration enhances efficiency and helps lenders reduce costs while improving customer service.

Lenders of various sizes can benefit from scalable and flexible software that supports efficient borrower information authentication.

A comprehensive loan management system that integrates well with other systems enhances the overall lending processes, including consumer loan management, loan agreements, loan processing, and loan portfolio management.

It brings together various components, creating a cohesive and efficient workflow that benefits both lenders and borrowers.

Ensuring Data Security and Privacy

Data security and privacy are paramount in the digital age, especially in financial services.

Robust security measures like encryption, role-based access controls, and data backups are non-negotiable for protecting sensitive financial data.

For instance, strong user authentication methods, including multi-factor authentication (MFA), are essential to prevent unauthorized access to loan management systems.

Role-based access control (RBAC) allows administrators to grant permissions based on user roles, ensuring that individuals only access data pertinent to their responsibilities.

This minimizes the risk of data breaches and maintains the integrity of the information.

In addition, data encryption protects information both in transit and at rest.

Regular backups and a robust disaster recovery plan are crucial for business continuity.

These measures ensure that data remains secure and accessible even in the event of system failures, cyberattacks, or natural disasters.

Consistent updates and audits further strengthen the security posture of loan management systems.

Role of Machine Learning in Enhancing Compliance

Machine learning models can predict new loan approvals by analyzing historical data, ensuring decisions align with regulatory requirements.

These models improve accuracy in assessing creditworthiness and identifying high-risk applicants.

Plus, machine learning technologies help in the following ways:

- Detecting fraud and mitigating risks by identifying patterns linked to defaults

- Continuous monitoring and updating of these models to ensure they remain relevant and accurate over time

- Helping financial institutions stay compliant and make informed decisions based on sophisticated data analytics

This dynamic approach helps financial institutions stay compliant and make informed decisions based on sophisticated data analytics.

Customizable Workflows for Regulatory Requirements

Customizable workflows in loan management software are essential for meeting specific regulatory requirements across different regions and industries, including business loans.

These dynamic workflows can adapt to changing business and regulatory demands, providing the flexibility needed to process applications quickly and efficiently.

Document management systems within loan software can:

- Flag documents as ‘QC critical’ for mandatory quality control reviews

- Ensure that all necessary compliance checks are performed

- Maintain high standards and reduce the risk of regulatory breaches.

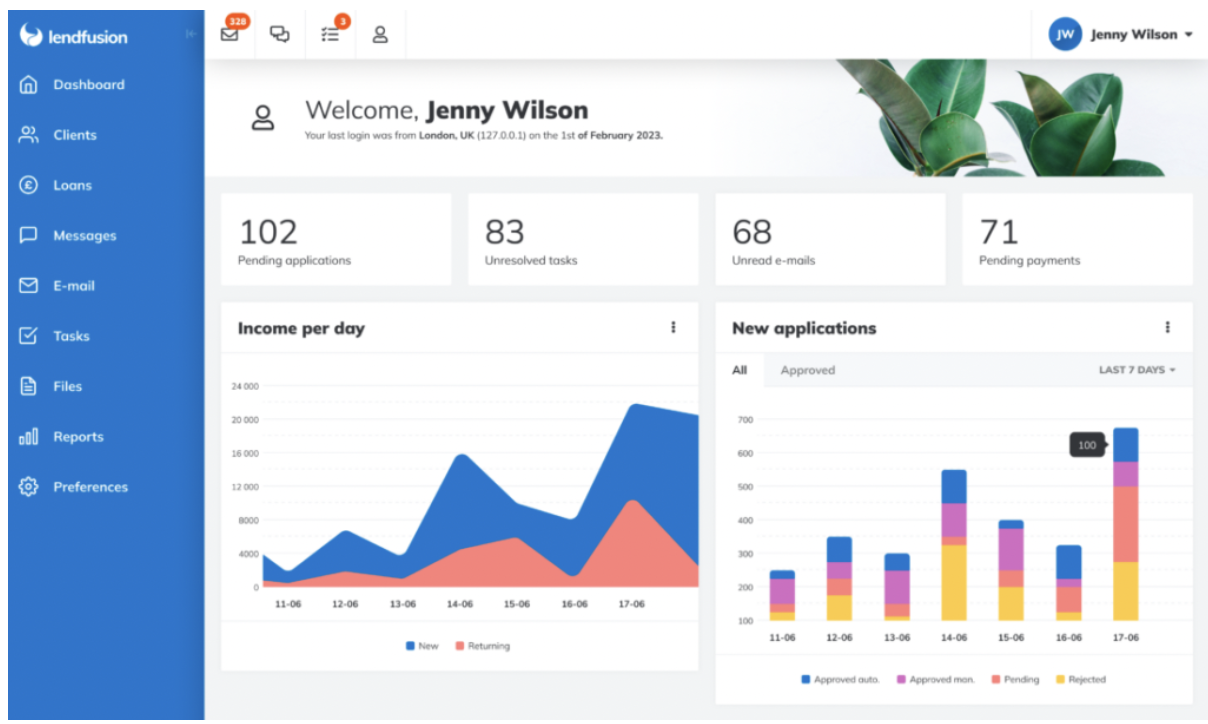

Real-Time Monitoring and Compliance Dashboards

Real-time monitoring and compliance dashboards in loan management software provide actionable insights that are crucial for informed decision-making.

By leveraging real-time data, lenders can manage portfolio exposures and concentrations more effectively.

Integrated analytics offer valuable insights into loan performance, leading to more precise risk modeling and decreased loss rates.

Compliance alerts configured within these dashboards can optimize the recovery process and mitigate the risk of overdue payments.

This holistic approach ensures that compliance management is both proactive and dynamic.

Staying Compliant with Evolving Regulations

Staying compliant with evolving regulations is a critical aspect of risk management for financial institutions.

Regular updates to loan management software are essential for adhering to new legal requirements and preventing potential legal issues.

Technological innovations play a significant role in helping institutions stay ahead of regulatory changes and enhance their compliance management strategies.

Monitoring legislative updates is crucial to ensuring the best practices of data and system protection.

As regulations change, lenders must adapt quickly to maintain compliance and avoid the pitfalls of non-compliance. Regular software updates can incorporate changes in anti-money laundering and fraud prevention measures.

Benefits of Using Loan Management Software for Compliance

Using loan management software for compliance offers numerous benefits, including:

- Reduced operational costs

- Improved efficiency

- Automation of manual tasks

- Elimination of redundancies

- Focus on strategic growth (i.e. offering new types of loans)

- Cost savings and enhanced customer satisfaction through digital loan applications

Real-time monitoring and cloud-based loan servicing software offer several benefits for lenders and borrowers, including:

- Improved security

- Enhanced convenience

- Real-time updates on loan status

- Increased transparency

- Improved customer experience

Choosing the Right Loan Management Software for Compliance

When choosing loan management software for compliance, several factors need to be considered.

Functionality and features are paramount, ensuring the software meets all operational and regulatory needs.

Integration capabilities are also crucial, as the software must seamlessly connect with core systems and other essential platforms.

Security measures, including robust encryption and multi-factor authentication, are essential for protecting sensitive data. Additionally, high-quality vendor support is critical for smooth operation and compliance with regulations.

This support should include quick technical assistance and industry-specific knowledge.

Scalability is another important factor, allowing the software to handle user capacity, loan volume, and support future growth.

→ See how LendFusion Drives Business Scalability for Setana

There’s one more factor to consider:

Custom loan management software may be necessary for unique loan operations, ensuring seamless integration with internal systems and regulatory compliance.

(What’s the best loan management software? Read our in-depth review here).

Conclusion

Loan management software – like LendFusion – is an invaluable tool for ensuring compliance in financial institutions.

With features like automated reporting, audit trails, compliance alerts, and real-time monitoring, these systems streamline processes and enhance transparency.

By integrating with core systems and credit bureaus, ensuring data security, and leveraging machine learning, institutions can stay ahead of evolving regulations and improve operational efficiency.

Choosing the right software involves considering functionality, integration, security, and vendor support, ensuring a comprehensive solution for compliance.

Book a Demo of LendFusion Today

Discover how LendFusion’s comprehensive loan management software can help you streamline your compliance processes and enhance operational efficiency.

Book a demo today and see firsthand how our features like automated reporting, audit trails, compliance alerts, and real-time monitoring can revolutionize your compliance strategy.

Vahuri Voolaid, COO

Vahuri is the Chief Operations Officer at LendFusion. Vahuri has 8 years of experience in fintech with loan management software as a product owner and an MBA with a specialisation in IT management.

Connect with Vahuri on LinkedIn.