5 Ways Automation in Loan Management Software Enhances Lending Operations

Loan management software is changing how loans work through automation by introducing efficiencies that are transforming the process for lenders and borrowers.

- For lenders, it means a dramatic reduction in the time and resources spent on manual tasks.

- For borrowers, it translates to faster loan approvals and more personalized service.

By embracing automation, the loan management industry is not only keeping up with current technological trends but is also setting new standards for operational excellence and customer satisfaction.

These advancements are having a widespread impact across the finance world, marking a new phase of innovation and expansion in lending practices.

In this article, we look into the impact of automation on the lending process and how it streamlines lending operations, from accelerating loan approvals to refining risk assessment techniques.

📘 Free Template: Loan Operations Health Check Template

A practical guide to conduct a health check on your loan operations with useful tips on how to resolve the most common issues.

Unlocking the Potential of Automated Loan Management

Automated loan management solves loan management challenges that have long plagued the lending industry.

Automation tackles manual data entry woes, minimizes data duplication, and enhances client communications, heralding a new era where the lending process meets the convenience and efficiency expected by modern consumers.

CEOs of lending businesses cannot ignore automation, as it not only improves the management of loans but also addresses late payments and eliminates common manual processes (i.e. tracking loans in Excel).

Said another way:

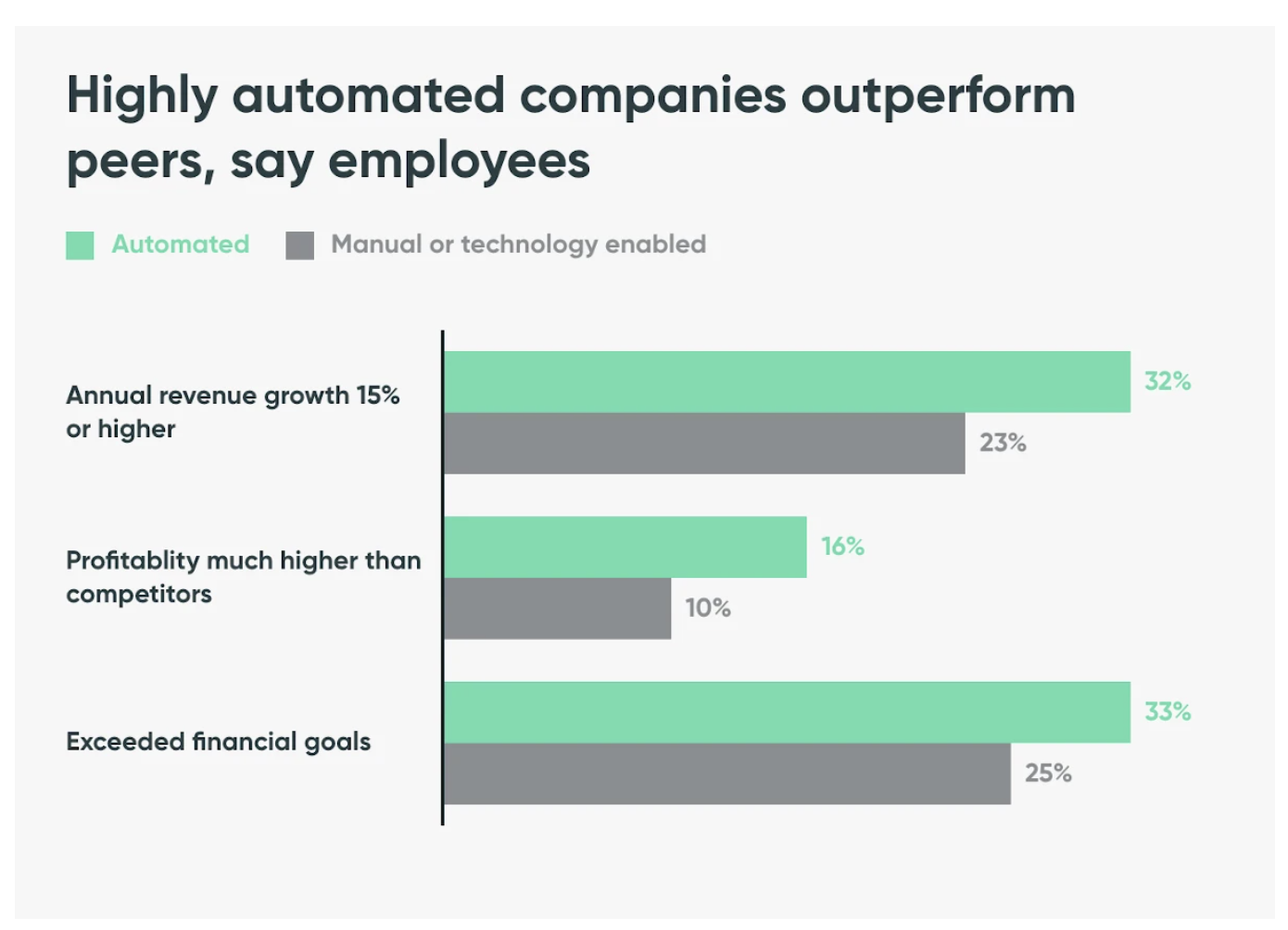

Companies that leverage automation are more likely to increase annual revenue, earn higher profits and exceed their financial targets.

In fact, companies embracing loan management automation not only streamline their operations but also witness a significant boost in their financial performance, with a reported 15-20% increase in annual revenue.

The Automated Advantage in Loan Origination

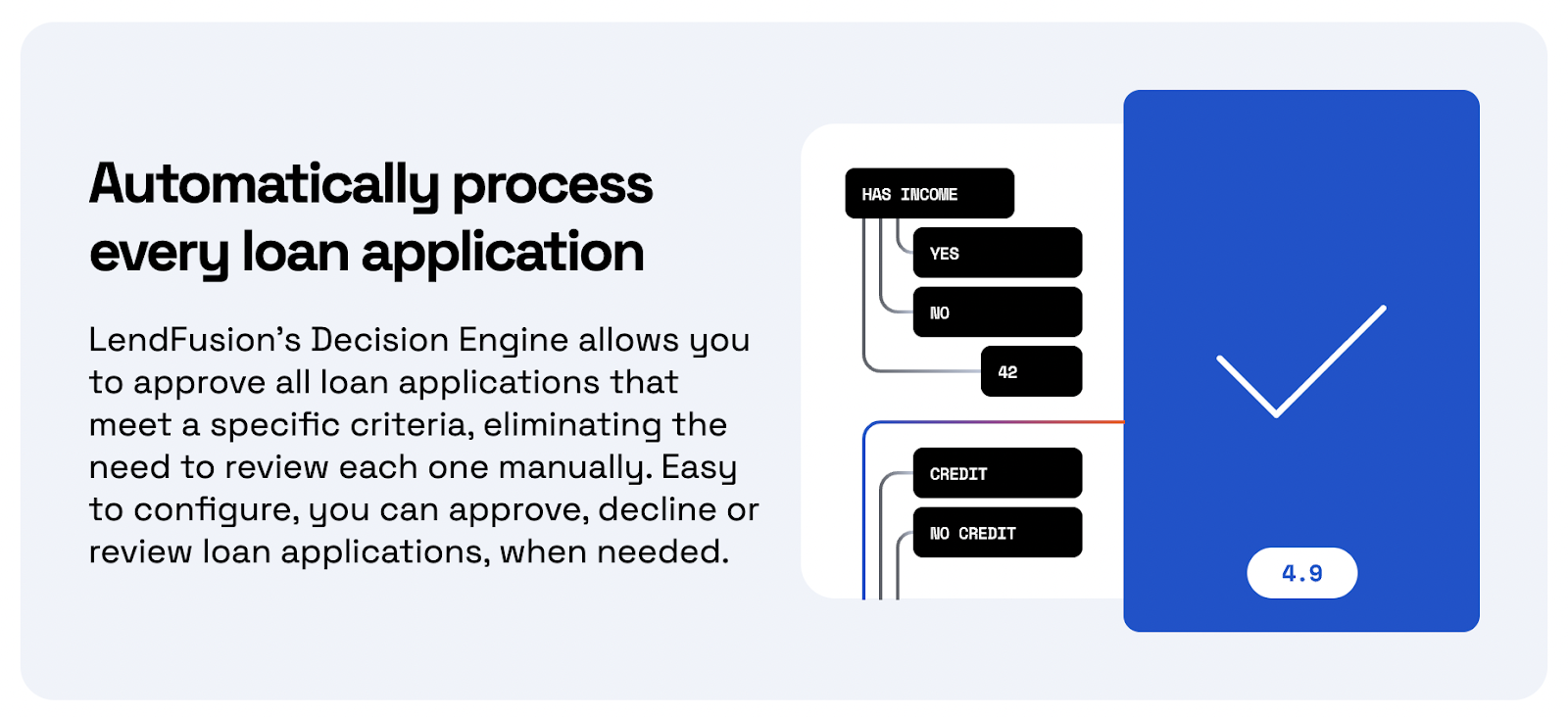

Robotic Process Automation (RPA) has streamlined the document review and verification process, ensuring necessary documentation is correctly in place, thus enhancing the accuracy and speed of the loan origination process.

By incorporating automated credit scoring models, lenders have revolutionized the loan approval process, slashing decision times by up to 70% and expanding their processing capacity by more than 30%, enabling a more diversified and robust loan portfolio.

This leads to a more diversified and balanced loan portfolio, which is fundamental for risk mitigation and financial stability.

Another benefit:

The borrower’s experience has been substantially improved.

Automation allows for consistent communication throughout the loan disbursement process, ensuring borrowers are well-informed and engaged.

This level of attention to borrower experience is a testament to how automation in loan origination software is reshaping the lending process to be more borrower-centric.

Smarter Loan Servicing Software

Automation has made loan servicing software much smarter.

Loan management software now streamlines the entire loan process, presenting a holistic approach to the loan life cycle that was once a patchwork of processes.

It can handle tasks such as:

- Managing loans and repayments

- Handling amortization schedules

- Generating reports and analytics

- Automating communication with borrowers

- Integrating with other systems

In addition, the flexibility in reporting and monitoring loan portfolios has never been greater.

Some of the key features include:

- Customizable dashboards

- Ability to generate modifiable reports

- Secure messaging

- Document sharing

- Real-time notifications

These features have empowered decision-makers with the tools needed for informed collaboration and decision-making. They have also contributed to effective communication throughout the loan servicing process.

Enhancing Credit Decisions with AI

AI’s intelligent document processing capabilities have substantially reduced manual data entry errors and validated data from loan documents, which in turn improves the accuracy of credit decisions.

In addition, by applying machine learning algorithms, AI helps to:

- Mitigate biases in credit scoring for fairer evaluations

- Identify patterns and trends in borrower data for more accurate risk assessment

- Automate repetitive tasks, freeing up loan officers’ time for more strategic decision-making

These advancements in AI technology are leading to better lending best practices and more efficient loan management processes.

AI-driven systems have also empowered lenders to:

- Process complex datasets and variables quickly, resulting in more rapid lending decisions

- Increase the volume of loan origination

- Enhance the accurate assessment of borrower creditworthiness, which is critical in minimizing default risks and improving operational efficiency

AI’s role in doubling approval rates and reducing credit losses by up to 20% underscores its significant positive impact on risk management.

Revolutionizing the Lending Process with Automation Tools

Automation tools are driving significant changes in the loan process.

By minimizing manual tasks such as document management and borrower interaction, these tools are not just cutting down on labor but are also ensuring strict regulatory compliance and reducing legal expenses.

The productivity improvements of 35-50% for lending teams speak volumes about the effectiveness of these automation tools in transforming the lending industry.

From Application to Approval: Simplifying Steps

Automation is changing the entire process from applying for a loan to getting it approved.

By electronically filtering applications, automating document gathering, and speeding up the underwriting process through web-based portals and APIs, the application process has become a model of efficiency.

Centralized electronic access to customer documents ensures a consistent and accurate source of information, facilitating a streamlined and compliant application process.

Furthermore, digital onboarding offers the following benefits:

- Expedited process, resulting in a seamless experience for both new prospects and existing customers

- Paperless processing and digital signatures, eliminating the need for physical paperwork

- eKYC integrations automate customer identity verification, ensuring compliance with AML and KYC regulations

- Empowers small business lenders to quickly onboard applicants and offer competitive online lending products, challenging larger institutions.

Risk Management and Analysis

The importance of automation in improving risk management is clear.

Leveraging cutting-edge machine technology, the lending industry has achieved a significant improvement in predicting default risks, enhancing the accuracy of borrower creditworthiness assessments by an impressive 25%.

Automated credit assessment tools expedite the evaluation process, enabling informed and timely loan authorizations.

The integration with credit bureaus for comprehensive borrower credit reports and the use of AI to predict borrower risks contribute to well-informed lending decisions.

Real-time analytics within automated systems provide immediate insights into the risk profile of loan portfolios, enabling financial institutions to:

- Identify and address issues proactively

- Implement AI-driven debt collection strategies

- Automate the creation of collection schedules

- Streamline the decision-making process

- Improve operational efficiency in recovering debts

This further solidifies the role of automation in risk management.

Payment History and Debt Collection

Automated systems have made the difficult job of collecting payment and debt much easier.

By categorizing debts, prioritizing collection tasks, and segmenting debtors, these systems not only streamline the process but also enhance it with analytical strategies to drive improvements.

The transparency provided by automation in loan management, with real-time access to data and performance metrics, ensures a meticulous approach to managing payment history and minimizes the risk of errors.

Additionally, the integration of debt collection systems with business-critical platforms has heightened the efficiency of loan management operations.

Automated debt collection systems also uphold:

- Regulatory compliance

- Data security

- Implementation of encryption and role-based access controls, which are fundamental for maintaining trust and integrity in the financial sector.

Integrating Automation into Existing Systems

Seamless integration is the cornerstone of successfully incorporating automated loan software into a lending business’s existing systems.

A flexible approach to integrating with multiple back-office systems or legacy tools is essential to reap the full benefits of automation, which includes the elimination of manual data entry and the enhancement of operational efficiency.

Bridging the Gap with Existing Customer Data

Harnessing the power of AI and predictive analytics can bridge the gap between loan management software and existing customer data to improve customer service.

Here are some benefits of using AI and predictive analytics in loan management software:

- Continuous adjustment to new financial behaviors, ensuring the relevance and accuracy of credit scoring and lending decisions

- Anticipation of potential defaults or payment issues, promoting proactive loan management

- Improved customer satisfaction

In addition, integrating loan management software with CRM systems offers several benefits, including:

- Improved sales efficiency due to the accessibility of accurate and up-to-date customer information

- Seamless flow of customer data, eliminating the risk of data entry errors

- Enhanced customer experience

Ensuring Smooth Transition with Staff Training

The transition to an automated system can be smooth with the right staff training and accountability measures in place.

Here are some steps to ensure a successful transition:

- Provide training materials that incorporate correct financial terminology and establish clear transition requirements.

- Train staff members on how to properly interact with the new system.

- Promote accountability by establishing roles and committees to manage responsibilities within the new software environment.

By following these steps, lenders can ensure an efficient and effective transition to an automated system.

(Note: Tired out outdated technology? Learn how to migrate from one LMS to another).

In instances where the internal team cannot resolve issues with the new software, customer support from the software provider plays a crucial role in troubleshooting and problem resolution.

This level of support is essential for maintaining the continuity of operations and maximizing the benefits of a loan management system.

The Financial Impact of Loan Automation

The financial implications of loan automation are profound, with the potential to cut operational costs by up to 50% and deliver an impressive ROI in the first year of implementation.

This is a testament to the transformative power of automation in not only streamlining processes but also in significantly impacting the bottom line for lending businesses.

Reducing Operational Costs with Automated Processes

Automation reduces operational costs by eliminating manual workflows, digitizing documents, and reallocating staff to tasks that add more value to the business.

This shift away from low-value manual workflows and towards digitized, consistent, and less error-prone processes is a key factor in the operational efficiency gains observed in lending businesses that have embraced automation.

Calculating ROI of Loan Automation

Calculating the return on investment (ROI) is an essential step for financial institutions when considering the adoption of an automated loan management system.

This substantial ROI indicates that the benefits of adopting loan management software, such as cost savings and increased efficiency, far outweigh the initial investment costs.

It is a compelling argument for CEOs of lending businesses to consider automation as a strategic investment that can yield significant financial rewards.

Customization and Scalability in Loan Management

A robust loan management system must be capable of supporting variations in loan products and adapting to the evolving needs of the business to remain competitive and responsive to market demands.

Tailoring to Your Business Needs

Customizing loan management software to meet specific business needs is integral to streamlining the application process and improving backend office efficiency.

Some benefits of customizing loan management software include:

- Personalization of processes to match the distinct needs of lenders and their clientele for various loan products

- Streamlining the application process

- Improving backend office efficiency

Cloud-based, configurable loan management software allows for the personalization of processes to match the distinct needs of lenders and their clientele for various types of loans.

The automation features within loan management systems simplify the customization of loan packages, making previously time-intensive tasks more efficient and adaptable.

This personalization is crucial for creating loan offers that cater to specific market segments, thereby enhancing customer satisfaction and streamlining processes.

Planning for Growth: Scalable Solutions

Scalable loan management systems are the backbone of business growth, providing the framework needed to expand loan portfolios while simultaneously improving data security and managing overall risk.

Automated loan management solutions with scalability features allow for virtually unlimited loan processing capacity, ensuring that lenders can grow without being constrained by their technology infrastructure.

The use of cloud-based loan management software offers a subscription model that makes scaling operations more cost-effective, as it does not require substantial investment in physical infrastructure.

This flexibility is invaluable for lenders who need to adjust their use of specific features to sync with their evolving business needs.

Optimal User Experience for Lenders and Borrowers

Automation not only streamlines loan processing but also significantly enhances the user experience for both lenders and borrowers.

By increasing the speed of credit application processing and loan issuance, automation contributes to a more satisfying customer journey, fostering greater loyalty and retention.

The responsive nature of cloud-based loan management software is crucial for a customer-centric approach, ensuring that the needs of clients are met with the immediacy they have come to expect in the digital age.

Digital Onboarding for a Seamless Start

Digital onboarding simplifies the initial stages of loan application, creating a positive first impression that is critical for establishing trust and rapport with clients.

In addition, configurable online loan applications tailored to specific customer needs and loan products underscore the personalized approach that modern customers demand.

The significant benefits of digital onboarding include:

- Reduction in onboarding times and costs

- Enhanced efficiency

- Positioning lenders as forward-thinking and client-oriented entities in the competitive lending market.

Keeping Customers Informed and Engaged

Automation tools have transformed the way lenders maintain customer relations, providing a platform for consistent engagement and information delivery.

By catering to client preferences with convenient services like loan applications and timely payment notifications, lenders can ensure a superior customer service experience.

The seamless integration of loan servicing software with CRM systems furthers this goal by streamlining communication and transactional processes, ensuring a consistent and informed customer journey.

Conclusion

Automation is reshaping the lending industry.

By streamlining processes, enhancing customer experiences, and delivering significant financial benefits, automation empowers lenders to operate with unprecedented efficiency and precision.

For CEOs of lending businesses looking to stay ahead of the competition and unlock growth opportunities, automation presents an opportunity to transform their approach to loan management.

With loan automation, you get:

- Substantial cost reductions and a high ROI

- Customization and scalability to ensure the system grows with the business

- Optimal user experience to retain customer loyalty

Put simply:

Lenders are not only investing in technology.

You’re investing in the future of your business.

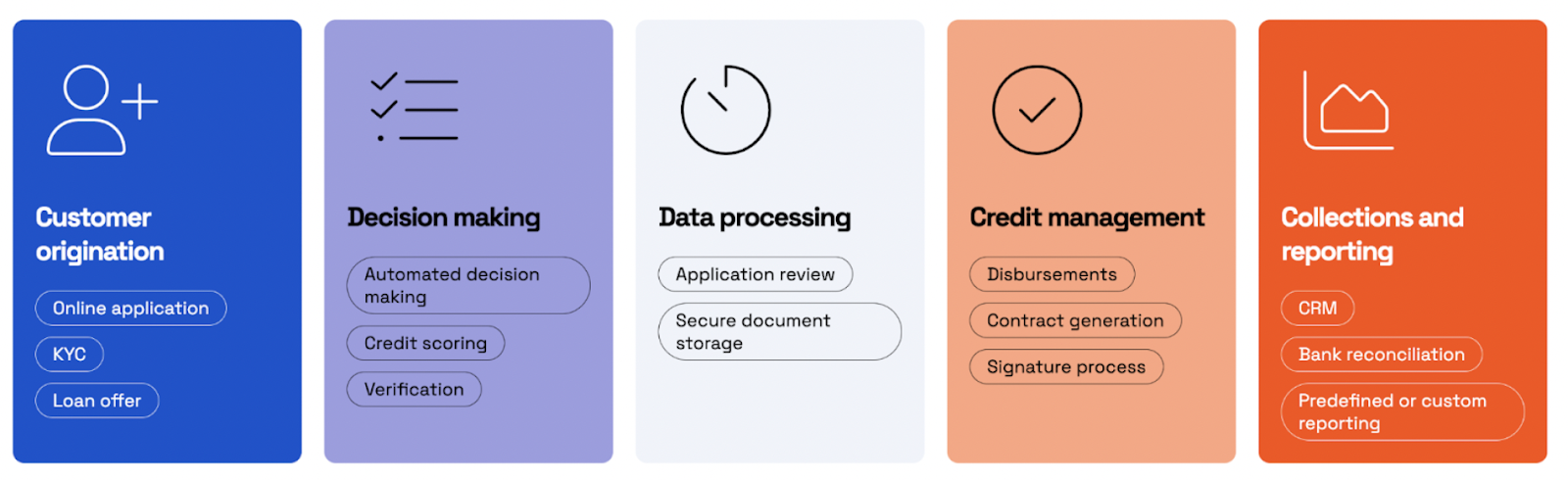

Automate Operations with LendFusion

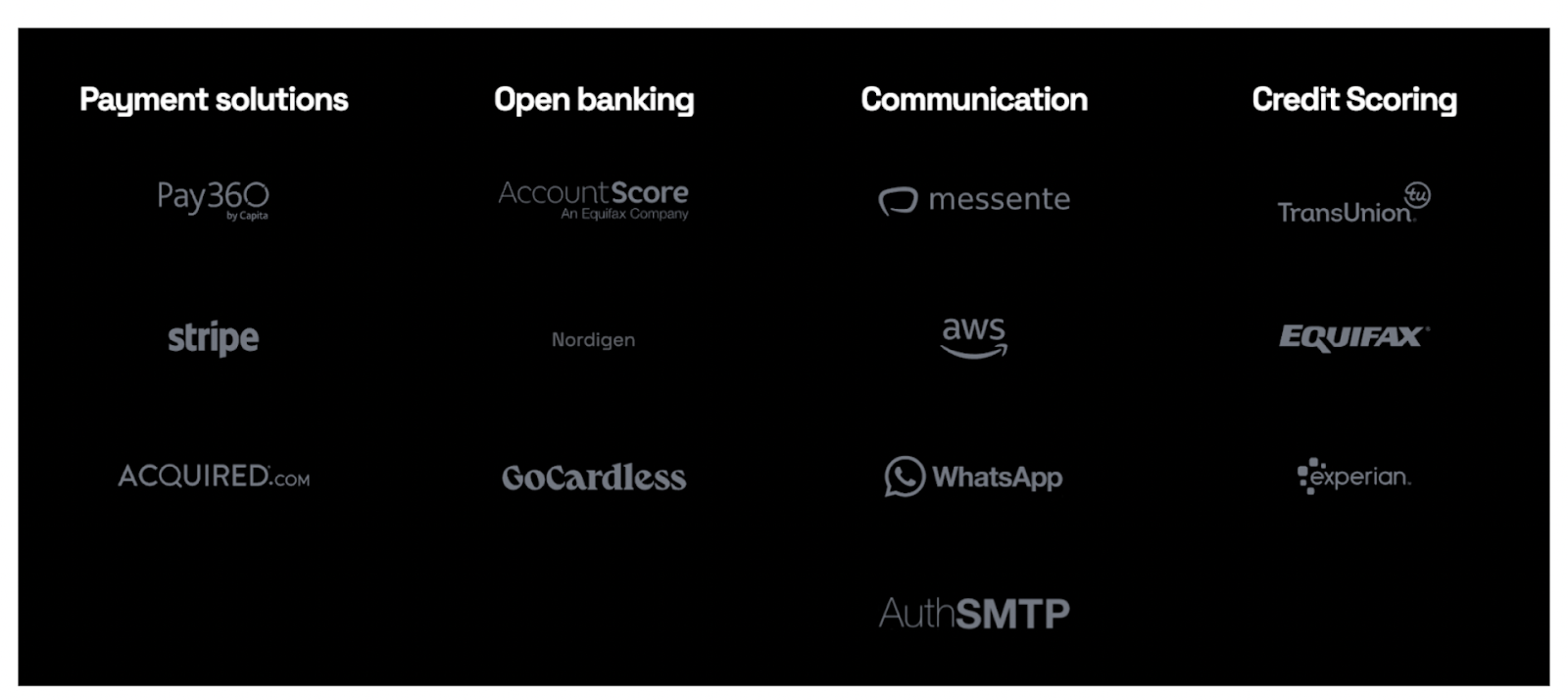

LendFusion is a loan management platform built for established lenders like you. Our highly automated, user-friendly and affordable system is designed to manage the entire lending process.

The key features of LendFusion include:

- High levels of automation

- Comprehensive loan origination and servicing

- Seamless integration with business tools

- Dynamic workflows

Book a demo today and one of our experts will show you how LendFusion can help you reach your business goals.

Lenders also ask

What are the key steps involved in transitioning from manual loan processing to automated loan processing?

Transitioning from manual loan processing to automated loan processing involves several key steps.

First, lenders need to conduct a thorough assessment of their current processes to identify areas where automation can provide the most benefit.

This includes mapping out each step of the loan lifecycle, from application to approval and loan servicing.

Next, choosing the right loan automation software that aligns with the lender’s specific needs and integrating it with existing systems is crucial.

This step often requires collaboration with IT professionals to ensure seamless data migration and system compatibility.

Training staff on the new system and gradually rolling out the automated processes can help ensure a smooth transition.

Finally, continuous monitoring and optimization of the automated workflows are essential to address any issues and improve efficiency over time.

How does loan automation impact the roles and responsibilities of loan officers and other staff members?

Loan automation significantly impacts the roles and responsibilities of loan officers and other staff members.

Automation takes over repetitive and time-consuming tasks, such as data entry, document management, and loan underwriting, allowing loan officers to focus on more value-added activities like customer service and complex loan assessments.

This shift can enhance job satisfaction as employees engage in more strategic and rewarding work.

However, it also requires employees to develop new skills to manage and oversee automated systems. Providing comprehensive training and support is essential to help staff adapt to their evolving roles and responsibilities.

What are the potential risks or challenges associated with implementing loan automation, and how can they be mitigated?

Implementing loan automation comes with potential risks and challenges that need to be mitigated.

One of the primary concerns is data security, as automated systems handle sensitive customer information. Ensuring robust cybersecurity measures, such as encryption and access controls, can help protect data integrity.

Another challenge is the potential resistance to change from staff accustomed to manual processes. Addressing this requires effective change management strategies, including clear communication about the benefits of automation, training, and involving employees in the transition process.

Additionally, the initial implementation phase can be complex and may require significant time and resources.

Planning meticulously, setting realistic timelines, and seeking expert assistance can help navigate these challenges.

By anticipating and addressing these risks, lenders can maximize the benefits of loan automation while minimizing potential drawbacks.

🚀 Ready to Take Your Lending Business to the Next Level?

Download our Loan Operations Health Check Template and learn how to diagnose your lending business and remove the hurdles stopping you from growing your business.

No fluff — just practical examples, templates, and expert tips.

No sign-up required. Just download and start improving your lending business today.

Vahuri Voolaid, COO

Vahuri is the Chief Operations Officer at LendFusion. Vahuri has 8 years of experience in fintech with loan management software as a product owner and an MBA with a specialisation in IT management.

Connect with Vahuri on LinkedIn.