10 Best Loan Management Softwares for 2025

We’ve personally reviewed the best loan management software platforms based on features, benefits and price. For established lenders, we recommend LendFusion and for large IT teams, we recommend Finastra.

Loan management software is designed to help lending businesses manage their entire end-to-end process more efficiently. Typically, loan management software uses automation to improve loan servicing and origination, as well as reporting and customer care.

Choosing the right loan management software to operate your business is a huge decision.

The trouble is, with so many options available, it’s easy to be confused by all the tools out there.

So, to help you kickstart your loan management system search, we’ve narrowed down the market to 10 of the best tools for you to choose from.

We’ll be looking at key features, pros and cons – and most importantly pricing – to give you an unbiased view on which loan management software is going to be the right choice for your lending business.

The best loan management software solutions include LendFusion, LoanPro, HES FinTech, Turnkey-Lender, Finastra and more.

But, before we review each platform…

📘 Free Checklist: Loan Management Software Buyer’s Comparison Checklist

A practical checklist to verify that you have covered the most critical elements for your business when choosing a new loan management software. Simplify your process by comparing vendors side-by-side.

What is Loan Management Software?

Loan Management Software (LMS) is a digital platform designed to streamline the entire lending lifecycle, from application to repayment. It automates key processes such as loan origination, servicing, and collection, which helps you enhance efficiency, reduce errors, and improve customer experiences.

An LMS supports lenders in managing loan portfolios, assessing risks, and ensuring regulatory compliance, making it an essential tool for modern lending businesses.

Key features of loan management software include the ability to facilitate faster loan origination. By automating data collection, analysis, and approval processes, these systems significantly reduce the time it takes to process loan applications, benefiting both lenders and borrowers with quicker decisions and fund disbursement.

Another key feature is efficient loan servicing, which.automates regular tasks such as payment processing, account updates, and report generation, thereby ensuring that loans are serviced effectively and in a timely manner.

This not only saves time but also enhances customer satisfaction by providing borrowers with up-to-date information and seamless transaction experiences.

The benefits of loan management software are driving significant investment, which is why the market is expected to grow to €30 billion by 2030, up from €11 billion in 2022.

So, now it’s time to look at the ten best LMS platforms on the market.

First up, we’re going to look at LendFusion.

1. LendFusion

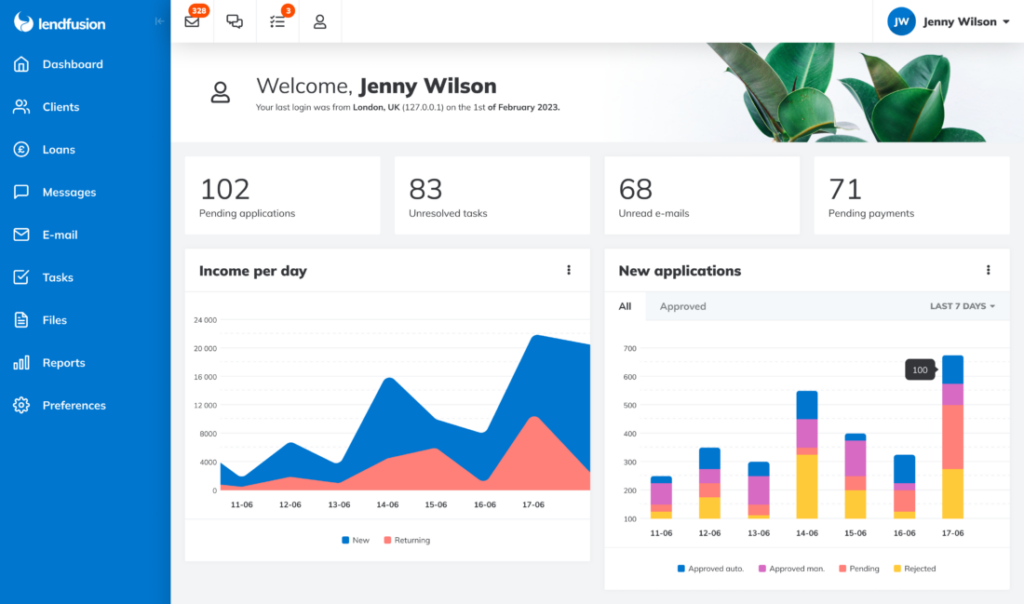

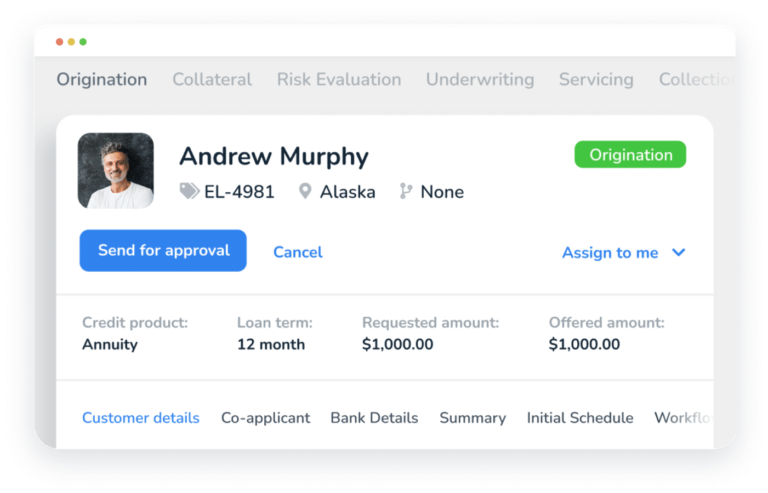

LendFusion stands out in a crowded market of loan management software options. This is thanks to a wide range of features aimed at mortgage lenders, credit unions, and loan brokers.

LendFusion includes a decision engine, audit trail features, and a customer portal – out of the box. Giving you everything you need for your lending business.

It’s also competitively priced, making it a top choice for established lenders looking for all-in-one loan management software.

Decision Engine

LendFusion’s Decision Engine is a key part of its loan management system. It’s designed to speed up the lending process by automating loan application reviews. This cuts down on the need for manual checks.

The engine uses data from various sources, like credit bureaus, to make instant smart decisions, saving time and effort.

LendFusion also uses set criteria to help you process loan applications in record time. This is ideal for mortgage lenders who have a high volume of loan applications.

The Decision Engine helps lenders to make fast, well-informed choices on loan applications – making their entire loan process more efficient.

Audit Trail Feature

LendFusion’s audit trail feature offers:

- Detailed recording of changes, fees, and transactions.

- Increased transparency and responsibility in managing loans.

- A reliable system for handling document transactions.

- Easy tracking of all changes in the loan book.

- A full audit history of loans.

Additionally, the audit trail helps with regulatory compliance. It includes tools for detailed record-keeping, creating compliance reports, and providing standard reports to meet regulations.

This makes LendFusion a complete solution for loan services, promoting accuracy and helping to prevent fraud.

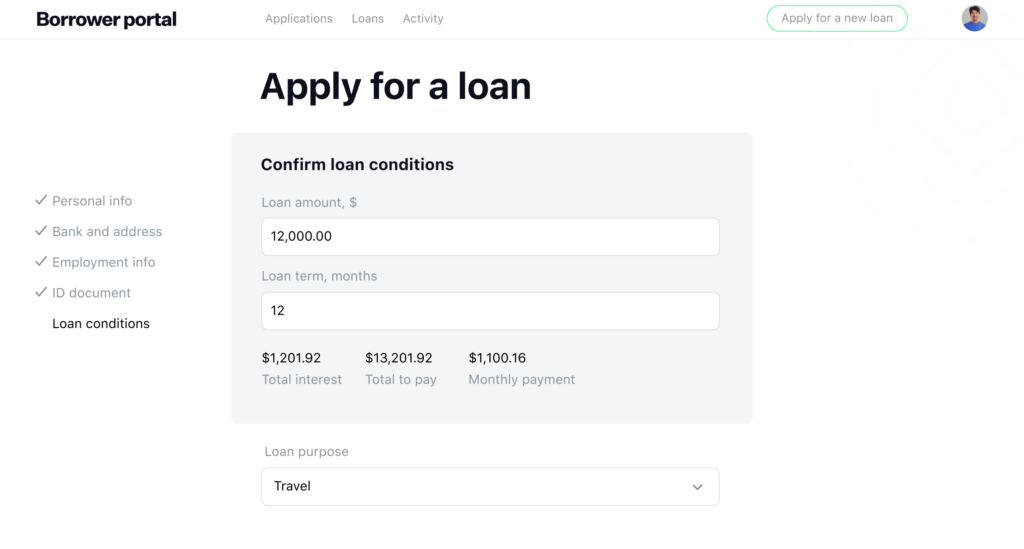

Customer Portal

LendFusion’s customer portal allows lenders to provide a ‘best in class’ customer experience. Their online platform provides;

- A personal area for customers.

- The ability to apply for loans.

- Tools to configure loan products.

- Automated processes.

- A built-in CRM system.

The portal streamlines the loan servicing process for both lenders and borrowers – and allows customers to;

- Check their loan balances

- View payment plans & loan documents

- Look at transaction history

- Make online payments

The LendFusion portal is also highly secure and GDPR compliant. This guarantees a safe and trustworthy experience for customers.

LendFusion: Pros and Cons

Like any software, LendFusion has its benefits and drawbacks. Here’s a look at three pros and three cons of using LendFusion for loan management:

Pros:

- Comprehensive Features – LendFusion gives lenders everything they need for effective loan management.

- Versatility – LendFusion is ideal for a range of lenders, including mortgage companies, credit unions, and loan brokers.

- Regulatory Compliance – The audit trail helps to maintain records, and produce compliance reports, to keep your business compliant.

Cons:

- Complexity: LendFusion has a wealth of features. But, this might be overwhelming for smaller lenders, leading to longer training time.

- Resource Demands. To get the most out of LendFusion you will need to be focused during implementation. This means smaller lenders might find it more challenging to dedicate enough time.

- Customization Limits. LendFusion is very customizable – but it has limits. While we try to accommodate all lenders, we may not be suitable for more unique business needs.

Pricing

LendFusion’s pricing starts at €1,659 monthly for loan portfolios up to €1 million. There are different pricing systems available which LendFusion is happy to discuss over the demo meeting.

LendFusion is a smart choice for any lending business CEO. It offers a wide range of features that make the lending process more efficient.

It’s flexible and customizable, serving different types of lenders, and use cases.

All this, plus a focus on compliance and security make LendFusion’s loan management system a great investment for your lending business.

💡Top Tip: LendFusion scales alongside your lending business and includes all the features you’ll ever need – as well as technical and product support – for a fixed monthly fee.

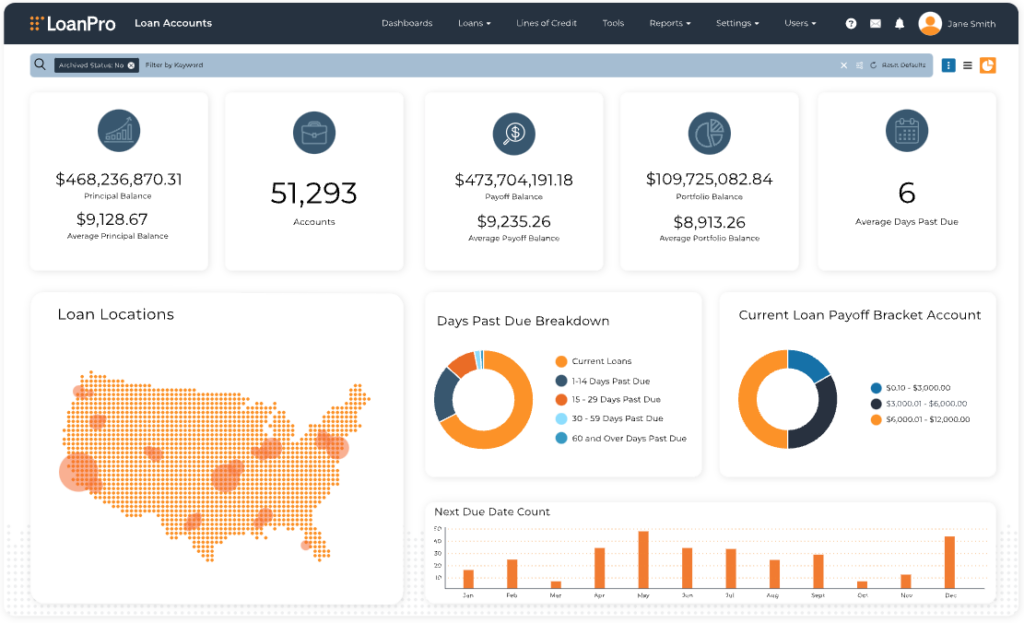

2. LoanPro

LoanPro is an API-based lending solution that is scalable, easy to use, and simple to integrate.

Its main use case is to streamline lending operations and boost efficiency.

LoanPro is flexible. It handles a variety of loan and credit card types for different industries and lenders.

Scalability and Flexibility

LoanPro stands out for its scalability and adaptability. It allows lenders to tailor the platform to their specific needs.

LoanPro provides powerful automation, customizable lending workflows, and clear data insights and analytics.

It can help banks and fintech, as well as B2B, traditional, alternative, and online lenders.

LoanPro also offers a Servicing Suite, Payments & Collections Suite, and Customer Relationship Manager.

Its ability to scale makes LoanPro a strong, flexible loan servicing solution.

Integration Possibilities

LoanPro’s API-based design is key to its integration power. The API efficiently manages various data tasks including;

- Creating

- Updating

- Deleting

- Retrieving

This is great for automating lending workflows and providing information in real time. This allows you to create a fantastic experience for your customers.

LoanPro also boosts efficiency by integrating with your other systems. This will help you to improve your current operations.

LoanPro can also sort loans by status, sub-status, and portfolio – to make loan management even more efficient.

Pros

- Scalability and Flexibility: LoanPro’s design focuses on scalability and adaptability. Being API-first also means it can improve the lending process in a range of industries.

- Integration Capabilities. The API at the heart of LoanPro allows it to share data with other systems. This gives you huge flexibility to improve your lending operations.

- Operational Efficiency: LoanPro aims to streamline lending. Its API-first approach makes it possible to manage almost any type of loan or credit card. This flexibility makes it a top choice if you need to manage loans in a variety of sectors or lenders.

Cons

- Complexity: LoanPro might be too complex for newcomers to loan management software. This could lead to a longer learning, training, and implementation period.

- Limited Customization. LoanPro offers a wide range of features and integration options, but it isn’t as customizable as other loan management systems. This could make it difficult to meet specific business requirements with LoanPro.

- Pricing: The cost of LoanPro could be a concern for smaller lenders. It is higher in price than other loan management software.

Pricing

LoanPro tailors the cost to the unique needs of each lender. This can make it difficult to control costs.

A key positive of LoanPro is its ability to scale and integrate well with existing systems.

Plus, LoanPro’s automation features increase efficiency, letting CEOs concentrate on expanding their business.

💡Top Tip: With its API-first approach, LoanPro may be better suited to companies with a large tech team. It’s also not as customizable as some other loan management software platforms.

3. HES FinTech

Next is HES FinTech, a loan management platform powered by Artificial Intelligence.

HES FinTech excels with its AI-driven credit scoring and flexible workflow automation. This makes it a prime option for lenders aiming to use AI to improve their lending processes.

AI-Powered Credit Scoring

AI-Powered Credit Scoring: HES FinTech’s standout feature is its AI-Powered Credit Scoring. It helps to make loan decision-making more efficient by;

- Quickly analyzing numerous data points.

- Speeding up the loan approval process.

- Cutting down wait times for consumers.

- Offering well-informed decisions, benefiting those with marginal credit scores.

HES FinTech’s AI-driven credit scoring also improves loan recovery by;

- Providing precise, personalized assessments of credit risk.

- Making the scoring process more efficient through machine learning.

- Saving time and resources.

- Decreasing manual errors.

- Increasing the reliability of lending decisions.

- This thorough method creates a strong and flexible credit scoring system.

Customizable Workflow Automation

Another key feature of HES FinTech is its flexible workflow automation. This lets lenders;

- Adjust their loan software to fit their unique lending methods.

- Streamline their operations.

- Increase the efficiency of their lending activities.

HES FinTech can also support processes like loan changes, creating tailored financial products, and adding new lending methods.

This adaptability makes HES FinTech a versatile option for various lending tasks.

Pros

- AI-Powered Credit Scoring: HES FinTech helps make loan decisions more easily with AI. It quickly analyzes lots of data, speeds up approvals, and makes smarter choices.

- Customizable Workflow Automation: HES FinTech lets lenders customize their loan management software. This allows them to mirror processes, streamline operations, and improve lending efficiency.

- Innovative Technology: HES FinTech stands out by using AI. This gives lenders a modern tool for their operations.

Cons

- Complexity: HES FinTech’s AI features might be too complex for new users. This could lead to a longer learning and training period.

- Limited Customization: HES FinTech has many features and allows for workflow customization. However, it might not be as flexible as other loan management systems. As a result, it has the potential to not meet certain unique business needs.

- Implementation Time: It may take some time to set up HES FinTech, because of its advanced features. This could be a drawback for lenders needing a fast solution.

Pricing

HES FinTech’s LoanBox costs between $20,000 to $70,000, based on specific needs and requirements.

A lending business will value HES FinTech for its AI credit scoring and flexible workflow automation.

The software helps to speed up loan approvals, improve loan recovery, and provide customized lending methods. This all contributes to greater efficiency in your lending business.

💡Top Tip: HES FinTech’s software uses AI to help make loan management more efficient. That being said, AI will soon become standard in all platforms due to the positive impact it has on loan management platforms.

4. Turnkey Lender

Finally, let’s look at Turnkey Lender, an all-in-one lending automation platform.

It uses its own AI for credit scoring and serves a wide range of clients, including non-bank, embedded, and traditional lenders.

Turnkey Lender is flexible loan management software that meets the needs of many different types of lending.

Proprietary AI for Credit Scoring

Turnkey Lender’s own AI focuses on accurate credit scoring. It also aims to improve loan recovery and overall lending results.

The AI looks at consumer data, spots behavior trends, and performs risk assessments and credit scoring. It’s mainly used in credit decision-making and risk analysis.

Turnkey Lender follows credit decision processes based on its own AI algorithms, to improve lending performance.

It also uses machine learning during the loan process to train itself for better loan results over time. This helps to make the lending process more efficient and effective.

Target Users

Turnkey Lender serves many types of lenders, offering a versatile platform for different lending needs. Whatever type of lender you are, you’ll find the platform’s solid infrastructure valuable.

It automates loan origination, underwriting, servicing, debt collection, and reporting. Turnkey Lender also matches the varied demands of the current lending market well, making it a flexible choice.

Pros

- AI-Powered Credit Scoring: Turnkey Lender’s AI improves loan decisions by quickly analyzing multiple data points. This helps it to speed up approvals and make smarter choices.

- Versatility: Turnkey Lender serves a range of lenders, including non-bank, embedded, and traditional. This adaptability makes it a good fit for various lending institutions.

- Comprehensive Features: Turnkey Lender is feature-rich and includes AI for credit scoring. These features give lenders everything they need for effective loan management.

Cons

- Complexity: Turnkey Lender’s advanced features might overwhelm Some users. This could lead to increased implementation or training time.

- Cost: Turnkey Lender is more expensive than many other loan management options. This means it could be a challenge to justify for smaller lenders.

- Limited Customization. Turnkey Lender isn’t as customizable as other loan management systems. This may rule it out of meeting specific business requirements for niche lending.

Pricing

Turnkey Lender tailors their pricing to your lending institution’s specific needs.

A lending business will value Turnkey Lender for its automation and AI. This is because it will improve loan decision-making and efficiency.

Its adaptability for various lending tasks makes it a flexible and effective option.

💡Top Tip: Be careful to compare the full offering from providers like Turnkey as things like Support are priced separately, compared to LendFusion who include it in their fixed price.

5. BrightOffice

BrightOffice is a UK-based loan management system known for its simplicity and effectiveness in managing small to medium loan portfolios.

Designed for SME lenders and financial services, BrightOffice provides tools that cater to various aspects of loan management, from origination and underwriting to document management and compliance.

Integrated Document Management System (DMS)

One of BrightOffice’s standout features is its built-in Document Management System (DMS), which organizes, generates, and securely stores loan documents.

This DMS is tailored to the needs of SME lenders who may not have extensive in-house document management capabilities. The system automates the creation of loan agreements, contracts, and compliance documents, reducing the administrative workload on teams.

Users can also track and audit documents in real-time, which simplifies compliance reporting and internal auditing.

Pros

- User-Friendly Interface: BrightOffice’s design is straightforward, with intuitive navigation that requires minimal training, making it accessible to teams without advanced technical expertise.

- Robust Document Management: BrightOffice’s DMS provides a comprehensive way to handle and track documentation, especially important for maintaining regulatory compliance in the UK.

- Competitive Pricing for SMEs: BrightOffice’s pricing structure is designed to be affordable for smaller lenders, providing a good value for money with core functionalities that support growth.

Cons

- Limited Advanced Features: BrightOffice may lack advanced automation and integration capabilities needed by larger or more complex lending businesses.

- Scalability Constraints: BrightOffice is ideal for SME lenders but may struggle to support very high loan volumes or more diverse loan products as a lender grows.

- Minimal Customization Options: While the platform offers core features out of the box, customization is limited compared to some competitors.

Pricing

BrightOffice offers a flexible pricing model, starting at around £500 per month. Pricing is scalable with added features and loan volumes, which can be tailored to the needs of smaller lenders looking for an accessible and practical solution.

6. Appello

Appello is a digital lending platform designed for banks and financial institutions with a strong focus on loan origination, risk assessment, and automation.

Known for its flexible architecture, Appello supports different types of loans, from mortgages to SME and consumer loans, while providing a scalable solution for financial institutions of various sizes.

Comprehensive Loan Origination and Workflow Automation

Appello’s loan origination module allows lenders to automate various stages of the loan lifecycle, from application submission to credit checks and approval processes.

The platform’s workflow automation can be customized, enabling institutions to set specific criteria for different loan types.

This flexibility is particularly valuable for lenders managing complex products, as it reduces manual intervention and accelerates the time-to-approval for loan applications.

Pros

- Streamlined Loan Origination: Appello’s end-to-end loan origination process is designed to simplify and automate lending workflows, which reduces administrative workloads and expedites approval times.

- Advanced Risk Assessment Tools: The platform includes built-in risk assessment features that integrate with third-party data sources, such as credit bureaus, enhancing the creditworthiness evaluation process.

- Customizable for Diverse Loan Products: Appello is adaptable to various loan types, from personal loans to mortgages, making it highly versatile for institutions with a broad lending portfolio.

Cons

- Implementation Complexity: Setting up Appello’s automation and custom workflows can be resource-intensive, making it better suited for institutions with dedicated IT teams.

- Higher Cost for Smaller Lenders: Due to its enterprise-grade features, Appello’s cost may be challenging for smaller lenders with limited budgets.

- Learning Curve: With its range of functionalities, Appello can be complex for teams new to digital lending platforms, potentially requiring additional training.

Pricing

Appello offers customized pricing based on the institution’s needs and loan volume, with costs generally starting around £2,000 per month. This flexibility allows Appello to cater to both medium-sized and large institutions, though it is typically better suited for larger organizations.

7. Finastra

Finastra is a comprehensive loan management and digital banking platform designed for global financial institutions, large banks, and credit unions.

As a leading provider in the fintech space, Finastra’s loan management system includes advanced functionalities for loan origination, servicing, risk assessment, compliance, and reporting.

Advanced Risk and Compliance Management

Finastra’s FusionBanking excels in its risk and compliance management capabilities, providing real-time risk analytics and automated regulatory reporting tools.

This functionality helps institutions adhere to global and local regulations, from KYC/AML compliance to complex financial reporting standards.

The system’s real-time monitoring tools track market risks, credit risks, and operational risks, allowing institutions to manage their loan portfolios with greater control and accuracy.

Target Users

Finastra is ideal for multinational banks, large credit unions, and financial institutions that require a scalable and highly secure solution with built-in compliance features. It’s especially suited for those who operate across borders and need tools to meet diverse regulatory requirements.

Pros

- Unmatched Compliance and Security: FusionBanking provides high-level compliance tools and risk analytics, meeting regulatory requirements for multinational financial institutions.

- Scalability for Large Portfolios: The platform is designed to handle very high loan volumes, making it suitable for large lenders and banks with complex portfolios.

- Customizable and Feature-Rich: Finastra’s system can be customized to handle a variety of loan types, offering flexibility for institutions with diverse portfolios.

Cons

- High Cost: The robust capabilities come at a premium price, making FusionBanking more suitable for large institutions rather than smaller lenders or SMEs.

- Complexity: Due to the range of features, implementation and onboarding can be extensive, requiring a skilled IT team.

- Limited Suitability for Smaller Markets: While comprehensive, Finastra may be too complex or costly for local or small-scale lenders that don’t require extensive compliance and security capabilities.

Pricing

Finastra offers tailored pricing, with costs often starting around £10,000 per month depending on the institution’s needs. It’s generally suited to large financial organizations with substantial budgets for technology and compliance.

8. Nortridge

Nortridge is a legacy loan management system designed for institutions that prioritize control, flexibility, and long-term vendor stability. Known for its powerful rules engine and deep configurability, Nortridge is especially suited to lenders with in-house IT resources and the need for on-premise or hybrid deployment.

The platform supports a wide variety of loan types – consumer, auto, commercial, and real estate—and includes robust servicing and accounting capabilities. It’s trusted by mid-sized lenders, credit unions, and banks who need precise control over their loan workflows, compliance logic, and operational data.

Advanced Rules Engine and On-Premise Flexibility

A standout feature of Nortridge is its granular rules engine. It enables lenders to define complex servicing conditions – such as fee schedules, accrual methods, repayment hierarchies, and delinquency logic – without relying on external development. This makes it highly adaptable for lenders operating across diverse loan products or jurisdictions.

Nortridge also offers full on-premise hosting, appealing to institutions with strict data control, cybersecurity, or regulatory requirements. While a cloud-hosted version is available, many customers choose Nortridge for its infrastructure flexibility and independence from third-party cloud providers.

Target Users

Nortridge is best suited to mid-size lenders, credit unions, and banks with internal technical teams that need detailed configuration, full control over hosting, and a proven platform for managing complex portfolios.

Pros

- Granular Configuration: Nortridge’s rules engine supports detailed, lender-specific workflows for servicing, collections, and reporting – ideal for complex or niche portfolios.

- On-Premise Deployment: Unlike most modern LMS platforms, Nortridge offers true on-premise hosting, appealing to institutions with strict IT or compliance policies.

- Built-In Accounting: The system includes integrated accounting tools, reducing the need for separate ledger systems or third-party reconciliation processes.

Cons

- Dated UI/UX: Nortridge’s user interface hasn’t kept pace with modern SaaS competitors, which can impact team adoption and ease of use.

- Steep Learning Curve: Configuring and operating Nortridge often requires technical knowledge, making it less suitable for lean or non-technical teams.

- Slower Implementation: Compared to newer cloud-based systems, Nortridge deployments can take longer and require more upfront IT planning.

Pricing

Nortridge uses a quote-based pricing model, typically suited to mid-to-large institutions with specific infrastructure and compliance needs. Pricing varies based on modules and deployment method.

9. nCino

nCino is a cloud-based loan origination platform built specifically for banks, credit unions, and other regulated financial institutions. Developed on the Salesforce platform, nCino offers an end-to-end solution that spans onboarding, origination, servicing, and portfolio management.

It’s designed to improve operational transparency, enhance compliance, and reduce the time to fund across retail, SME, and commercial lending. As a market leader in cloud banking, nCino is especially popular among financial institutions that need tight CRM integration and regulatory alignment.

Built on Salesforce for End-to-End Lending

One of nCino’s standout features is its native integration with Salesforce. This gives users a unified experience across customer relationship management and loan workflows – allowing teams to originate, approve, and monitor loans from a single interface.

The platform also includes robust analytics, automated workflows, and credit risk management tools, making it ideal for institutions that require both front- and back-office alignment. nCino’s compliance tools help banks meet evolving regulatory obligations, particularly in the US, UK, and EU markets.

Target Users

nCino is best suited for mid-to-large financial institutions – especially banks and credit unions – who want a unified, cloud-based system that tightly integrates CRM and loan management in a single, regulated environment.

Pros

- Salesforce Native: nCino’s tight integration with Salesforce ensures seamless workflows across origination, servicing, and relationship management.

- Compliance & Risk Features: Built-in risk assessment, document tracking, and audit trails help satisfy regulatory requirements across jurisdictions.

- Enterprise Scalability: nCino is built to handle complex, multi-product portfolios across diverse teams and regions, making it a strong fit for large institutions.

Cons

- Salesforce Dependency: Since nCino runs on Salesforce, institutions must also license and configure Salesforce separately – adding to total cost and complexity.

- High Implementation Costs: Deploying nCino can require significant consulting support, especially for larger portfolios or custom process mapping.

- Overpowered for Smaller Teams: The enterprise-grade feature set may be more than necessary for smaller or specialist lenders, creating inefficiencies.

Pricing

nCino uses custom pricing, often starting in the low five figures per month depending on institution size and configuration needs. Additional costs for Salesforce licenses, onboarding, and ongoing consulting should also be factored into the total investment.

10. Blend

Blend is a digital lending platform designed to streamline mortgage and consumer loan origination through sleek borrower experiences and intelligent automation. Used by top US banks and fintech lenders, Blend helps reduce friction across the loan process with pre-filled applications, verification integrations, and real-time document collection.

While originally focused on mortgages, Blend has since expanded to support personal loans, auto finance, home equity, and deposit account openings – all from one unified interface.

Consumer-Grade UX Meets Enterprise Lending

Blend’s core strength lies in its intuitive, white-labeled borrower interface. Applicants can complete complex forms quickly, upload documents, and verify income or identity—all from mobile or desktop. Behind the scenes, lenders benefit from rule-based automation, workflow orchestration, and third-party integrations (like Plaid, Experian, and payroll providers).

This makes Blend a top choice for lenders who want to reduce abandonment rates, speed up decisions, and compete on borrower experience.

Target Users

Blend is ideal for banks, credit unions, and fintech lenders with a focus on consumer lending – especially those looking to modernize the mortgage experience or unify multiple origination flows into one front-end.

Pros

- Best-in-Class UX: Blend delivers one of the cleanest, fastest borrower interfaces in lending—reducing time-to-apply and improving completion rates.

- End-to-End Origination: Blend supports everything from initial applications to closing and compliance workflows, especially in mortgage.

- Deep Integrations: Built-in connections with payroll, credit, and ID verification providers allow for seamless borrower onboarding and decisioning.

Cons

- Limited Servicing Capabilities: Blend is focused on origination, so lenders still need a separate LMS for loan servicing and portfolio management.

- US-Centric Platform: While powerful in the US market, Blend lacks native compliance tools for UK/EU lenders.

- Premium Pricing: Blend’s modern experience comes with a premium cost structure, which may be less appealing to smaller or niche lenders.

Pricing

Blend operates on a custom pricing model, typically starting in the €8,000–€15,000/month range depending on lending volume and product mix. Most features are bundled, but advanced modules or partner integrations may incur additional fees.

Choosing the Best Loan Management Software for Your Lending Business

Let’s compare 10 of the best loan management software platforms.

In the table below we’ve summarized criteria like;

- Ease of use

- Customization

- Integration

- Pricing

- Support options

These key criteria have a huge impact on user adoption, operational efficiency, and return on investment.

| Tool | Overview | Pros | Cons | Pricing | Ease of Use | Customization | Support | Rating |

|---|---|---|---|---|---|---|---|---|

| LendFusion | Comprehensive platform with audit trail and decision engine. | Versatile, feature-rich, regulatory ready. | Complex setup, limited customization. | €1659–€9999/month based on portfolio size. | Scalable, centralized, user-friendly. | Loan configurator + APIs. | Strong support. | ⭐⭐⭐⭐⭐ |

| LoanPro | API-first lending platform for scaling and flexibility. | Flexible, scalable, great integrations. | Complex, expensive for startups. | Custom pricing via consultation. | Easy to navigate, scalable UI. | Custom fields supported. | Reliable support. | ⭐⭐⭐⭐ |

| HES FinTech | AI-driven credit scoring + workflow automation. | Innovative tech, strong automation. | Setup can be complex, limited flexibility. | $20K–$70K depending on needs. | Centralized and easy to use. | Highly customizable processes. | Support only in enterprise plan. | ⭐⭐⭐½ |

| TurnKey Lender | All-in-one lending platform with AI scoring. | Feature-rich, great for credit scoring. | Complex and costly setup. | Custom pricing via consultation. | User-friendly dashboard. | API client integration available. | Paid support. | ⭐⭐⭐½ |

| BrightOffice | UK-focused LMS with compliance tracking. | Affordable, SME-friendly, UK-compliant. | Not ideal for large lenders. | From £995/month for basic. | Simple and intuitive. | Custom fields + API. | Dedicated support. | ⭐⭐⭐½ |

| Appello | Highly customizable LMS for lenders. | Flexible and automation-focused. | High setup cost, needs tech skills. | Contact for pricing. | Powerful but complex UI. | Advanced features, limited 3rd-party support. | 24/7 with SLAs. | ⭐⭐⭐ |

| Finastra | End-to-end cloud lending for large institutions. | Great global support, full-stack loan management. | Expensive, complex for small users. | Custom pricing based on needs. | Good for large teams, moderate complexity. | Strong API and cloud features. | Global, high-tier support. | ⭐⭐⭐⭐ |

| Nortridge | On-premise-capable LMS with deep configurability and accounting tools. | Highly flexible, strong for complex loan products, trusted by institutions. | Dated UI, steep learning curve, best for teams with IT resources. | Quote-based | Moderate, depends on config | Extensive but technical | Paid vendor assistance | ⭐⭐⭐⭐ |

| nCino | Cloud-based platform for banks with full loan lifecycle support. | Built for banks, deep integrations with Salesforce, strong compliance. | Requires Salesforce environment, complex implementation. | High—custom quote needed | Familiar to Salesforce users | Customizable via Salesforce | Enterprise-level support | ⭐⭐⭐⭐ |

| Blend | Modern mortgage and consumer lending platform with borrower-first design. | Great borrower UX, fast digital origination, white-label capabilities. | Primarily focused on front-end origination, limited servicing tools. | Custom pricing per institution | Highly intuitive | Strong front-end only | Dedicated account teams | ⭐⭐⭐⭐ |

Ease of Use

Four software solutions, LendFusion, LoanPro, HES FinTech, and Turnkey Lender, feature user-friendly interfaces. Key factors influencing user-friendliness include scalability, deployment, centralized access, speed & agility, functionality, customization, integration, compliance, security, and reporting.

Customization and Integration

Customization and integration capabilities are crucial. They can improve operational efficiency and overall productivity. Here are some key features from each of the 4 software vendors:

- LendFusion provides a loan product configurator and automated actions.

- LoanPro enables users to create custom fields.

- HES FinTech offers customizable lending solutions and process automation.

- TurnKey Lender allows the integration of its core features through an API client.

Pricing and Support

Pricing and support options can impact the return on investment and implementation success.

When procuring loan management software, you should consider the monthly cost, value for money, and level of customer support.

- LendFusion’s software starts from €1,659 per month.

- LoanPro offers a personalized pricing plan.

- HES FinTech’s LoanBox is priced between $20,000 to $70,000.

- Both LendFusion and LoanPro offer robust customer support.

Conclusion

Selecting the right loan management software involves considering a host of factors like ease of use, customization and integration capabilities, and pricing and support options.

LendFusion, LoanPro, HES FinTech, and Turnkey Lender are all best-of-breed platforms that help streamline the lending process in multiple ways.

As technology continues to revolutionize the lending landscape, staying informed about the latest advancements in loan management software is critical to maintaining a competitive edge.

We believe that growing your lending business should be easier.

That’s why we have developed LendFusion to give you everything you need ‘out of the box’ to operate your lending business.

Our all-in-one loan servicing solution includes;

- A powerful decision engine

- Detailed audit trail

- User-friendly customer portal

All built to meet the needs of various types of lenders across the industry.

Book a demo today with LendFusion and discover how an efficient, all-in-one loan servicing solution can help you grow your lending business.

Why trust us?

The LendFusion team has more than 10 years experience in digital lending and we have an extensive background in loan management. We’ve built the software to meet the needs of digital lenders today, based on real conversations with buyers and customers that use Excel, in-house systems and current loan management platforms.

Prior to LendFusion, we were lenders ourselves, so we have a deep level of understanding and insight into the products, features and services that businesses expect, in order to scale their business.

How we picked and tested the platforms

We all have expectations on what a loan management platform should offer and there are thousands of platforms to choose from – from generic (all-in-one platforms) to specific (bridge loan software).

Rather than decide for ourselves, we spoke to more than 120 buyers who were considering LendFusion to find out which other vendors they were speaking to.

Based on the responses, the shortlist of platforms to compare with LendFusion became LoanPro, HES FinTech and Turnkey-Lender. We’ll continue to speak with buyers and update this article based on the platforms they mention.

Customers also ask

How do loan management software platforms ensure data security and protect sensitive borrower information, in light of increasing cybersecurity threats?

Security measures in loan management software typically involve robust protocols to safeguard sensitive financial data.

At LendFusion, we use advanced encryption to protect data both while it’s being transmitted and when it’s stored. In addition, regular security audits and assessments are conducted to identify and mitigate potential vulnerabilities. Furthermore, we also have features like two-factor authentication and role-based access control put in place to prevent unauthorized access, along with regular updates to address new security threats.

What kind of support and training do loan management platforms offer to ensure smooth implementation and effective use of their software, particularly for businesses that may not have a robust IT department?

Loan management software providers understand the need for effective onboarding and usage of their systems. At LendFusion, we provide onboarding programs that include training sessions, video material, and extensive documentation.

For customers with limited technical expertise, we provide more hands-on assistance to ensure a smooth implementation and adoption.

How do these platforms plan to evolve with changing financial regulations and emerging technologies?

LendFusion is designed to scale with the growth of your business, handling increasing volumes of loans and expansion into new markets efficiently.

Keeping up with changing financial regulations is essential, and we continuously update our product and features to ensure ongoing compliance. Like many lending companies, we’re exploring the latest technologies, like artificial intelligence and automation to create new features and enhance existing functionality.

🚀 Ready to Take Your Lending Business to the Next Level?

Download our Loan Management Software Buyer’s Comparison Checklist and discover all the nuances to consider when shopping for a loan management platform. Identify, evaluate, estimate, compare.

No fluff — just practical examples, templates, and expert tips.

No sign-up required. Just download and start improving your lending business today.

Vahuri Voolaid, COO

Vahuri is the Chief Operations Officer at LendFusion. Vahuri has 8 years of experience in fintech with loan management software as a product owner and an MBA with a specialisation in IT management.

Connect with Vahuri on LinkedIn.